Tagged: Boston University

To Combat Adolescent Tobacco Use, Federal Law Raises Purchasing Age to 21

In the final weeks of 2019, in the wake of an outbreak of vaping-related illnesses and death, the federal government raised the minimum age of tobacco sales from 18 to 21. The widely-supported amendment to the Food, Drug, and Cosmetic Act was included in an appropriations bill that Congress approved on December 19th and President Trump signed into law the next day. The new law makes it illegal to sell tobacco products, including electronic cigarettes/vapes, to anyone under the age of 21 throughout the United States. While the law is a positive step for public health, it is long overdue and lacks much needed enforcement enhancement measures.

The federal government followed in the footsteps of 19 states, Washington D.C., and hundreds of local governments which had already increased the tobacco age to 21. The push to increase the tobacco age is referred to as the Tobacco 21 movement. The first Tobacco 21 law was enacted in Nedham, Massachusetts in 2005. In 2013, New York City became the first major city to pass a Tobacco 21 law. The wave of state-level Tobacco 21 laws began in 2016 with Hawaii and California, and continued with

Washington and New Jersey in 2017, Oregon, Maine and Massachusetts in 2018, Virginia, Illinois, Delaware, Arkansas, Maryland, Vermont, Texas, Connecticut and Ohio in 2019, and Washington, Utah, Pennsylvania, and South Dakota in 2020. New Mexico is the latest state to pass a tobacco 21 law which will go into effect in 2021.

The Tobacco 21 movement is supported by a strong foundation of research demonstrating the importance and efficacy of raising the age. In the Surgeon General’s 2012 report on Preventing Tobacco Use Among Youth and Young Adults, the epidemiological research showed that “adolescence and young adulthood represent[s] a time of heightened vulnerability to tobacco use and the initiation of cigarette smoking.” The rationale behind increasing the age from 18 to 21 is to reduce the number of people who begin smoking (or vaping) by making it more difficult to access tobacco during the years of highest vulnerability. And studies show that 98% percent of smokers begin before 26 years old and 90% of daily cigarette use begins before 20 years of age. Raising the age not only makes it more difficult for 18-20 year-olds to purchase tobacco, it also reduces access for minors who often rely on friends who are 18 and older to purchase tobacco products for them. In fact, it is estimated that “90% of persons who purchase cigarettes for distribution to minors are under 21.”

In addition to conventional cigarettes and tobacco products, Tobacco 21 laws also prevent people under the age of 21 from buying electronic cigarettes or vapes. This is because electronic cigarettes are deemed to be tobacco products by the FDA. Electronic cigarettes are the most commonly used tobacco products among youth today, and a 2018 study showed that 1 in 5 high school students and 1 in 20 middle school students use these products. Those numbers were likely even higher in 2019 when the mysterious vaping illnesses, which prompted this legislation, began. Even before the outbreak, the high rate of electronic cigarette use among American youth was troubling. Not only were public health officials warning of the known harms associated with vaping (such as potential for lung damage, and dangers of nicotine consumption for brain development), but also the universe of unknown risks associated with vaping as these products are relatively new and rapidly changing.

In addition to conventional cigarettes and tobacco products, Tobacco 21 laws also prevent people under the age of 21 from buying electronic cigarettes or vapes. This is because electronic cigarettes are deemed to be tobacco products by the FDA. Electronic cigarettes are the most commonly used tobacco products among youth today, and a 2018 study showed that 1 in 5 high school students and 1 in 20 middle school students use these products. Those numbers were likely even higher in 2019 when the mysterious vaping illnesses, which prompted this legislation, began. Even before the outbreak, the high rate of electronic cigarette use among American youth was troubling. Not only were public health officials warning of the known harms associated with vaping (such as potential for lung damage, and dangers of nicotine consumption for brain development), but also the universe of unknown risks associated with vaping as these products are relatively new and rapidly changing.

The vaping illness outbreak began in August 2019, when vaping product users— including many teens—suddenly began presenting to emergency departments with severe lung injuries. By December 4th, the Centers for Disease Control and prevention had confirmed over 2,200 cases and 48 deaths related to the outbreak. The reason for the sudden increase in vaping related illness was not immediately clear, and it stirred up panic among parents of teenagers and mobilized public health professionals who had long feared the harmful effects of vaping.

With the outbreak capturing the nation’s attention, Congress and the Trump administration were under pressure to do something to address the problem. With such powerful momentum in the Tobacco 21 movement, public health advocates and policy makers had already began calling for a federal Tobacco 21 law years ago (read more about that here, or here). Passing a federal Tobacco 21 law to address the vaping illness outbreak was an easy choice because, in contrast to more drastic measures such as banning electronic cigarettes entirely, raising the age enabled Congress to respond to the fear and public outcry surrounding the vaping illnesses in a manner that was actually supported by tobacco and vaping companies. While some advocates feel that raising the age was not a drastic enough measure to combat the vaping epidemic, it is certainly a positive step for public health and to combat tobacco consumption generally.

While the new law will make it more difficult for those under 21 to access tobacco products, the efficacy will depend largely on proper enforcement of the law. Enforcement of age restrictions on tobacco purchasing has been demonstrably poor, with many retailers still selling tobacco products to minors before the new law became effective. While amending the FDCA, Congress could have used this opportunity to not only raise the tobacco age but also to ramp up the enforcement mechanisms contained within the Act, by increasing funding, penalties or requirements on the number of compliance checks. Unfortunately, that did not occur and the new law. Without a change in the law to effectuate stricter enforcement measures, it will be difficult for the federal and state governments to oversee enforcement of the law and to make sure that retailers properly comply.

The federal Tobacco 21 law is a bittersweet victory for public health champions who have been warning against the risks of vaping and campaigning for an increase in the tobacco age since long before the mysterious vaping illnesses began. In order for our tobacco laws to truly be successful, our legislators must increase enforcement and properly fund measures that prevent the initiation of tobacco use. As with all areas of public health, we must act to prevent —not just respond once crises have already begun.

Rebecca Mashni graduated from The Ohio State University in 2015 with a B.S. in Public Health and graduated from Boston University School of Law in May 2020 with a J.D.

Rebecca Mashni graduated from The Ohio State University in 2015 with a B.S. in Public Health and graduated from Boston University School of Law in May 2020 with a J.D.

Making Big Tech Pay Their Share: The Taxation of Digital Advertising in Maryland

In sharp contrast to the bevy of tax incentives offered to Amazon as part of a bid for the so-called “HQ2,” Maryland has charted a path towards taxation of technology companies as part of its commitment and obligation to its residents. This move to hold large companies accountable for the money they derive from Maryland residents is laudable, given the amount of data mined from individuals and used to sell targeted digital advertising as well as the crisis of state budget shortages. However, as written, Maryland’s efforts raise serious legal concerns that jeopardize the viability of the current iteration of the bill. The bill draws on an existing model to achieve important social goals. However, in the context of the American legal framework, the current iteration of the bill raises First Amendment freedom of speech concerns and faces further challenges under the commerce clause and federal legislation enacted to promote and facilitate Internet commerce. These shortcomings need not be fatal, though. With modest redrafting, the policy underlying the bill could be implemented in order to fulfill Maryland’s goals.

The bill

Introduced in the Senate as Senate Bill 2 and in the House as House Bill 695, parallel bills in the Maryland legislature impose a

tax on gross revenues derived from digital advertising. The amount ranges from 2.5% for a corporation with annual gross revenues from $100 million to $1 billion up to 10% for those with gross revenues over $15 billion. The revenue raised will go to the Blueprint for Maryland’s Future Fund, which funds K-12 education improvements in the state. This policy, though lauded as the first attempt to tax digital advertising revenues in the United States, is not without global precedent. Rather, it is modeled after a French law, which levies a 3% tax on digital interface and “targeted advertising services” in France. The tax only applies to companies with global revenues from digital interface and targeted advertising of more than €750 million globally, with at least €25 million of which was derived from French users. France enacted this legislation July 11, 2019, and was quickly rebuked by the American business community. In particular, President Trump threatened countermeasures of tariffs up to 100% on $2.4 billion worth of French imports to the United States, including sparkling wine and cheese. As a result, France and the U.S. negotiated a pause on the enactment of the law on the condition that the threatened tariffs not go into place.

Like its French model, Maryland’s bill specifically targets large technology companies. The Fiscal and Policy Note for the Maryland bill calls out by name Alphabet (the parent company of Google), Facebook, and Amazon. Proponents suggest that this legislation will force tech companies to “pay their fair share” by contributing to local tax bases rather than reaping the benefits while paying only minimal tax obligations. However, the opponents are not without their own ammunition. As part of their strategy to defeat the underlying policy, they raise legal questions regarding the current drafting and scope of the bill.

Legal considerations

Opponents argue that the selective taxation represents a content-based restriction on free speech because it selectively targets some kinds of advertising based on its communicative content. Following the recent Supreme Court case of Reed v. Town of Gilbert, which expanded the category of what is considered a content-based restriction on speech, this kind of selective taxation could be viewed as falling into the category of speech subject to strict scrutiny and therefore unlikely to survive judicial review. Even as an exercise of commercial speech, subject only to intermediate scrutiny under Central Hudson Gas & Electric v. Public Service Commission, such a tax is unlikely to be sustained. Restrictions on commercial speech must be no broader than necessary to directly further a substantial government interest. Under these circumstances, improving K-12 education is likely a substantial government interest, but the program could not be considered narrowly tailored. There are other means of raising the necessary revenue without burdening commercial speech of only large technology companies.

Maryland’s tax also raises other, non-First Amendment concerns. As written, the bill could be construed as a violation of the commerce clause of the Constitution, because it would create the possibility of double taxation of the same single economic activity if every state were to adopt a similar regime, violating the “internal consistency” test. A final source of legal concern for the policy is the Permanent Internet Tax Freedom Act, or PITFA. PITFA prohibits state taxation of internet access as well as discrimination against online commerce. The taxation of digital advertising, but not traditional forms of advertising, could be seen as a discrimination against online commerce in violation of PITFA.

Maryland’s tax also raises other, non-First Amendment concerns. As written, the bill could be construed as a violation of the commerce clause of the Constitution, because it would create the possibility of double taxation of the same single economic activity if every state were to adopt a similar regime, violating the “internal consistency” test. A final source of legal concern for the policy is the Permanent Internet Tax Freedom Act, or PITFA. PITFA prohibits state taxation of internet access as well as discrimination against online commerce. The taxation of digital advertising, but not traditional forms of advertising, could be seen as a discrimination against online commerce in violation of PITFA.

Looking forward

The French example and advertising industry outcry against the Maryland proposal suggest that taxation of digital advertising will be a difficult prize to win. Significant political, economic, and legal hurdles remain. However, in an era of declining state revenues and K-12 funding crises, novel solutions must be sought. The digital advertising industry, reaping incredible profits, represents a tempting source of revenue for states dealing with these demands. However, as constructed, the policy presents serious legal shortfalls. This is not to say that the taxation of a major economic activity ought to be abandoned as a policy proposal. Rather, the specific construction of the statute needs to be reconsidered as the Maryland legislature moves forward. For example, a modification in the way that “in the state” is determined for the purposes of the tax could eliminate the concern of double taxation and, therefore, the commerce clause concerns. Where modest redrafting could save the policy from its legal challenges, it seems imperative to do so given the high stakes underpinning the policy.

Jordan Neubauer anticipates graduating from Boston University School of Law in May 2020.

Jordan Neubauer anticipates graduating from Boston University School of Law in May 2020.

Supplying Housing Demand: Gov. Baker’s Proposed Housing Choices Act

There is no question that Massachusetts generally, and the Boston area in particular, is mired in an affordable housing crisis. Renters and would-be buyers are heavily burdened with disproportionate housing costs and are forced to compete for a limited supply of units. As of 2019, Massachusetts rental costs climbed to the third highest in the nation, surpassed only by California and Hawaii, making this the rare occasion in which beating New York isn’t something to celebrate. To increase housing, the state must address the burdensome rules that hinder the development of new units; especially multifamily homes. One possible solution is the proposed Housing Choices Act.

Though there are many facets to this issue and no simple solution, Gov. Charlie Baker is focusing on attacking the restrictive zoning rules and arduous permitting processes. Gov. Baker argues these rules are causing shortfalls in housing stock, driving up prices as demand far outstrips supply. Gov. Baker’s bill, the Housing Choices Act, was stalled throughout 2019, until late December when it was referred to the House committee of Ways and Means.

The Act has garnered the support of organizations such as the Boston Medical Center, Real Estate Bar Association, Massachusetts Municipal Association, Massachusetts Association of Community Development Corporations, Metro Housing Boston, and many more.

Gov. Baker’s administration has set a target of building 135,000 new housing units by 2025 and the Governor believes rezoning to allow more multifamily construction is a key piece in increasing housing production. Since 2017, Gov. Baker’s Housing Choices Initiative has incentivized municipalities to help meet this target by providing grants to support housing construction, but access to those grants still requires communities to vote in favor of rezoning. The Housing Choices Act would simplify rezoning by reducing the threshold of votes needed to pass certain kinds of progressive, production-oriented zoning changes in Massachusetts municipalities from two-thirds to a straight majority vote. Massachusetts is among the few states which require a supermajority for these kinds of zoning votes. The Governor calls the Housing Choice Act a “critical” piece of legislation in pursuit of production goals because it will ease that rezoning process.

Among the zoning changes to which the new straight majority vote would apply are the adoption of “smart-growth” districts under Ch. 40R, which governs…. “Smart growth” includes the construction of multi-family buildings, special permits for high-density construction, the reduction of size and parking requirements, transit-oriented projects with a set percentage of affordable units, and permission to construct accessory dwelling units.

Criticism: Too Narrow or Too Broad?

Critics such as Darnell Johnson, regional coordinator at Right to the City Boston, however, believe that the bill “ignore[es] the needs of working families” and will only lead to more luxury condos and other housing out of reach for most Massachusetts residents. Chris Norris, executive director Metro Housing Boston, concurs, and points out that with 250,000 low-income households forced to spend upwards of 50% of their income on rent, “incentives alone are not sufficient to product affordable housing.” Norris cites the fact that Ch. 40R was passed in 2004, was expected to generate 33,000 new units over ten years, and more than $20 million has been poured into its incentives. As of 2017, however, this law has produced only 3,500 units, less than half of which are designated as affordable.

Advocates within and without the Baker administration counter that this bill is not meant to be a panacea for housing woes but rather a step in the right direction. Clark Zeigler, executive director of the Massachusetts Housing Partnership, points out that right now good housing proposals are defeated despite winning majority support because of the current two-thirds voting requirements. Such was the case in Salem, where a measure to increase accessory dwelling units, one of the Housing Choice Act’s targets, won the majority, but not supermajority, and thus failed to pass. Salem Mayor Kim Driscoll supports Gov. Baker’s efforts to prevent situations like this, calling on local authorities to pursue a “strong partnership with state leaders.” Once this problem is solved, MHP and other affordable housing advocates can and will continue pushing for further means of providing relief to those overly burdened by housing costs. In an official statement, CHAPA (Citizens’ Housing and Planning Association) made its support of the Housing Choice Act clear for the same reasons. “Lowering the super majority threshold required for zoning changes will empower the simple majority of people in a community to vote ‘Yes’ for housing.” CHAPA sees the bill as an essential opportunity to help communities “encourage housing development and undo policies that prevent housing production and perpetuate segregation.”

Another source of criticism is a fear that the bill would inevitably cause unwanted and overly dense construction which will damage the character of older neighborhoods. Similarly, Rep. Smitty Pignatelli (D-4th Berk.) proposes that the switch to straight majority be predicated on local approval out of concern for state-level infringement on local autonomy. Sen. Brendan Crighton (D-Lynn), co-chairman of the Housing Committee, does not believe this is a real cause for concern, insisting that the bill “doesn’t take away any local control. . . [but rather] puts together a more common-sense approach that says a majority of folks can make a decision on the matter.” He sees this and similar legislation as crucial because Massachusetts’ housing production is half of what it was in the 1970s while rent has risen by 75% over the past twenty years.

Some communities, such as Needham and Springfield, believe they and some 70 other municipalities should be exempt from the bill because 10 percent or more of their housing stock already meets state “affordability” thresholds. Needham Select Board Chairman John Bulian sees requiring his town to comply would be penalizing it despite its having exceeded Massachusetts’ affordable housing percentage goals. Such complaints, however, seem to miss the larger picture of spurring more housing growth by enabling local residents greater control over their zoning through simplified zoning vote processes.

Massachusetts is in a housing crisis—one that can only be fixed by finding a way to build more housing. An important first step is to reform the rules and processes that restrict the needed housing units.

Kellen Safreed anticipates graduating from Boston University School of Law in May 2021.

Kellen Safreed anticipates graduating from Boston University School of Law in May 2021.

Protecting Vulnerable Road Users: A Vicious Cycle

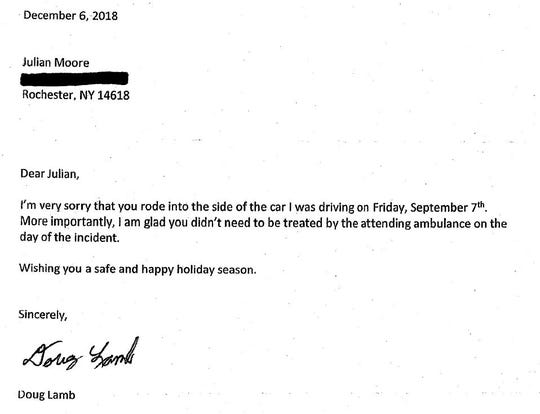

Ten-year-old, Julian Moore was riding his bicycle in a suburb in Rochester, NY on Sept. 7, 2018, when 66-year-old Doug Lamb hit him with his Range Rover.

Figure 1: Julian Moore and his mother, Jenny Moore, walk near the spot where Julian was hit while bicycling. (Photo: Max Schulte/Rochester Democrat and Chronicle).

Lamb stopped the car after his collision with Moore, but did not give his information to Julian, the paramedics, or Julian’s mother. By the time the police arrived, Lamb had departed the scene. It took two weeks for the police to track Lamb down and charge him with the misdemeanor crime of leaving the scene of an accident causing personal injury. Pittsford Town Judge John Bernacki had decided to adjourn the case in contemplation of dismissal, meaning Lamb’s record would be wiped clean, on the condition that Lamb write an apology to the boy.

His apology letter read:

This act of “contrition” drew sweeping public scorn in January after the boy’s mother, Jenny Moore, posted a copy of the letter on her Facebook Page and the backstory subsequently made headlines around the country. In response, prosecutors moved to re-open the case and proceed to trial for failing to meet the apology requirement of his plea deal.

Prosecutor Daniel Strollo said his office pursued the case to the extent that it did because Lamb neglected to meet the condition to which he agreed to resolve the matter. “Mr. Lamb was given one simple instruction: to send a letter of apology,” Strollo said. “He didn’t do that. When you don’t follow through on the terms of a commitment for a plea or a disposition of a case, our office is not going to just ignore it.”

Lamb plead guilty on Dec. 6 in Pittsford Town Court to leaving the scene of an accident causing property damage—a mere traffic infraction. In exchange, Lamb was ordered to pay a $200 fine, perform eight hours of community service.

Julian’s story garnered national attention for his crash. Lamb was protected by a 5,000-pound vehicle of steel. Julian was protected by a plastic helmet. If it seems ludicrous the legal system could enable Lamb to walk away with a small fine and apology, it may be time to even the playing field and shift legislative protections toward vulnerable road users such as Julian.

Vulnerable Road Users

All over the country, thousands of similar crashes are occurring in the shadows, without the benefit of a national audience holding drivers accountable. The National Highway Traffic Safety Administration data shows 857 cyclists were killed in crashes with vehicles the U.S. in 2018. The same study found Florida leading the country with 161 of those fatalities, finding bicycle deaths for those 20 and older have tripled since 1975.

However, Florida legislators are prepared to step up and do something about the mounting problem, formally adopting “Vision Zero Florida” with a strategic goal of zero traffic fatalities and severe injuries for all users. Part of this vision includes advocacy for a proposed bill, H.B. 455 – Traffic Offenses, in the Florida Legislature which provides criminal penalties for persons committing moving violations causing serious bodily injury or death to a vulnerable road user including: a fine, period of house arrest, mandatory driver education, revocation of driver license. One of the largest shifts however, is the establishment and definition of “vulnerable road user.”

The League of American Bicyclists, a national bicycle advocacy organization, defines a Vulnerable Road User (“VRU”) as “anyone who is on or alongside a roadway without the protective hard covering of a metal automobile. The term includes bicycle riders, pedestrians, motorcyclists, people in wheelchairs, police, first responders, roadway workers and other users like a person on a skateboard or scooter. It is meant to include people who are especially at risk of serious bodily harm if hit by a car, or truck.”

VRU laws operate on the principal of general deterrence - by providing an increased penalty for certain road behaviors that lead to the serious injury or death of certain road users people will be deterred from doing those behaviors around those users.

In 2007, Oregon became the first Legislature to pass, HB 3314, creating an enhanced penalty for careless driving if it contributes to serious physical injury or death to a “vulnerable user of a public way.” Currently, only nine 9 states have laws that define a vulnerable user or VRU and provide particular penalties for actions towards those vulnerable road users or when violations of traffic law lead to the serious injury or death of a VRU – Connecticut, Delaware, Florida, Hawaii, Maine, Oregon, Utah, Vermont, and Washington. In Texas, approximately 28 cities have passed their own VRU laws in the absence of a statewide version.

To advance this legislative effort, the League of American Bicyclists, proposes a model VRU statute for state legislatures. The model language: Section 1) defines VRU protected persons; Section 2) defines when the law is applicable and who can be charged with a violation of the law; Section 3) requires a person charged according to this law to attend a hearing; and Section 4) provides the punishments that are to be given to a person convicted of a violation of this law.

Road Ahead

Without enhanced protection for VRUs through increased penalties, it is common for a driver who kills or seriously injures a VRU to just be given a ticket for careless driving, as illustrated in a 2013 report by the Center for Investigative Reporting finding that in 238 pedestrian fatalities 60% of motorists found to be at fault or suspected of a crime faced no criminal charges.

As the closing lines of Prosecutor Strollo’s motion on behalf of Julian Moore states, “[t]he people are ready for trial.” Echoing a crystalizing national awareness that calls for increased protections to vulnerable road users, the people are ready for legislative change—and states legislatures should consider adopting a version of the VRU model law to meet this demand.

Alexandra Trobe anticipates graduating from Boston University School of Law in May 2021.

Alexandra Trobe anticipates graduating from Boston University School of Law in May 2021.

The Fight for LGBTQ+ Justice and the Equality Act

Throughout American history, the LGBTQ+ community has continually faced unconscionable levels of harassment, discrimination, and vitriol; Congress cannot waste another session without passing the Equality Act into law.

Discrimination against the community is pervasive; LGBTQ+ Americans have reported harm to their mental health (69%), physical well-being and safety (45%), school environment (39%), work environment (53%), and relationships with their neighbors and local communities (57%). More than half of LGBTQ+ Americans have faced discrimination by healthcare providers. In surveys, LGBTQ+ Americans admit to using vague language about relationships (42%), refusing to talk about their partner (37%), hiding affiliations to LGBTQ+ groups (15%) and avoiding discussion of LGBTQ+ issues altogether (31%) out of fears of facing harassment and other damaging bigotry. Additionally, LGBTQ+ people have often changed the way they dress (15%), changed the way they talk (15%), cut important people out of their lives (16%), and moved away from their families (17%) because of the harmful consequences of discrimination.

Furthermore, transgender Americans face a disproportionate share of violence and discrimination – even compared to other members of the LGBTQ+ community. 33% of trans Americans have been denied equal services or physically attacked when visiting a place of public accommodation (like a hotel, restaurant, or government office). 27% of trans workers have been fired, not hired, or denied a promotion because of their gender. Additionally, 25% have been refused treatment or physically assaulted by their primary physician, health clinic, or hospital due to their gender identity – despite new Affordable Care Act regulations that were written with the specific intention to prohibit such discrimination against trans Americans by federally-funded providers. Members of the trans community have reported avoiding public transportation (11%), stores and restaurants (26%), and going to the doctor (24%) for fears of facing abuse and violence.

Queer people face high rates of discrimination and violence because of state and federal inaction. In twenty-nine states, LGBTQ+ Americans can be fired from a job, evicted from their home, or denied a line of credit because their employer, landlord, or bank disapproves of their sexual orientation or gender identity. In fourteen states, there is no ban on LGBTQ+ discrimination in schools. Clear and universal legal protections for LGBTQ+ Americans are desperately needed if our country is ever going to heal the evils that have been done for generations against our vulnerable population.

Therefore, Congress must pass a bold LGBTQ+ civil rights bill – such as the Equality Act sponsored by Representative David Cicilline (D-RI). This legislation would amend the Civil Rights Act of 1964 to protect Americans from discrimination based on “sex, sexual orientation, gender identity, or pregnancy, childbirth, or a related medical condition of an individual, as well as because of sex-based stereotypes” in federal funding, education, housing, employment, credit access, jury service, and public accommodations. It covers claims based on: (1) association with another member of a protected class; or (2) a perception or belief, even if inaccurate, that someone is a member of that class. The Act would expand “public accommodations” to include “any establishment that provides a good, service, program,…health care, accounting, or legal services,” or “any…transportation service.” Furthermore, the Act prohibits denying individuals access to a “shared facility” (restroom, locker room, dressing room, etc.) in accordance with their gender identity. Finally, the bill allows the Justice Department to bring these claims in federal court, and prohibits anyone who violates the Equality Act from asserting protection under the Religious Freedom Restoration Act of 1993 (RFRA) as a valid defense to discriminating against LGBTQ+ Americans.

The Equality Act would be a crucial step forward for America. First, the bill expands protections under the Civil Rights Act of 1964 for all protected classes under the law, not just the LGBTQ+ community. For example, the bill would extend the Civil Rights Act’s current ban on discrimination based on sex to also cover public accommodations, state and local government services, and federal funding. Second, this bill would enact into federal law stronger anti-discrimination protections for the LGBTQ+ community than even the most liberal possible Supreme Court decisions could provide through Bostock v. Clayton County, Georgia (whether discrimination against an employee because of sexual orientation constitutes prohibited employment discrimination “because of . . . sex” within the meaning of Title VII of the Civil Rights Act of 1964, 42 U.S.C. § 2000e-2) or R.G. & G.R. Harris Funeral Homes Inc. (whether Title VII prohibits discrimination against transgender people based on (1) their transgender status or (2) sex stereotyping under Price Waterhouse v. Hopkins) this summer.

The Equality Act would be a crucial step forward for America. First, the bill expands protections under the Civil Rights Act of 1964 for all protected classes under the law, not just the LGBTQ+ community. For example, the bill would extend the Civil Rights Act’s current ban on discrimination based on sex to also cover public accommodations, state and local government services, and federal funding. Second, this bill would enact into federal law stronger anti-discrimination protections for the LGBTQ+ community than even the most liberal possible Supreme Court decisions could provide through Bostock v. Clayton County, Georgia (whether discrimination against an employee because of sexual orientation constitutes prohibited employment discrimination “because of . . . sex” within the meaning of Title VII of the Civil Rights Act of 1964, 42 U.S.C. § 2000e-2) or R.G. & G.R. Harris Funeral Homes Inc. (whether Title VII prohibits discrimination against transgender people based on (1) their transgender status or (2) sex stereotyping under Price Waterhouse v. Hopkins) this summer.

Finally, public opinion strongly supports passage of federal LGBTQ+ protections. 79% of Democrats, 56% of Republicans, and 70% of Independents polled in 2018 supported passage of non-discrimination laws to protect members of the LGBTQ+ community. This support includes a majority in every age group – from millennials to the elderly – and even includes a majority of white evangelical Protestants, a group that typically has conservative positions on social issues. Outside of polls, there are also a number of powerful interest groups supporting passage of the Equality Act. Such groups include civil rights organizations (ACLU, Anti-Defamation League, NAACP, AARP), women’s rights groups (NOW, CLUW), corporations (Visa, Mastercard, Apple, Google, Netflix, Microsoft, Amazon, eBay, IBM, Facebook, Airbnb, Twitter, Intel, American Airlines), medical and professional organizations (AMA, APA, ABA, National PTA), unions (CWA, SEIU, AFSCME, AFT), celebrities (Karamo Brown, Nyle DiMarco, Adam Rippon, Jesse Tyler Ferguson, Taylor Swift), and religious organizations (Episcopal Church, United Methodist Church, United Church of Christ, Evangelical Lutheran Church in America, More Light Presbyterians, United Synagogue of Conservative Judaism, Muslims for Progressive Values, Hindu American Foundation, Unitarian Universalist Association).

The Equality Act is certainly not perfect. An ideal bill would attack not just de jure LGBTQ+ discrimination, but also de facto discrimination caused by implicit biases and socioeconomic disparities. Such a law dedicated to establishing LGBTQ+ justice might: 1) specifically include HIV/AIDS status as a class of protected individuals covered by the Equality Act; 2) expand federal funding for Medicaid, public health clinics, mental health coverage, and combatting youth homelessness; 3) ensure all homeless shelters and rehabilitation centers receiving federal funds are LGBTQ+ affirming; 4) bolster protections against hate crimes, gun violence, and the targeting of LGBTQ+ populations by law enforcement; 5) require all private and public insurance plans to cover HIV prevention; 6) require school districts that receive federal funds to adopt sex education programs that are comprehensive and LGBTQ+ inclusive; 7) institute codes of conduct prohibiting bullying and harassment in our public schools; and 8) prohibit LGBTQ+ conversion therapy. However, under the current limitations of today’s Congress, the Equality Act seems a good first step towards building a broader movement for LGBTQ+ justice over the next decade.

Although polling shows that most Americans do not think “religious objections should be a reason to deny service to an LGBTQ person” in business (57%), healthcare (64%) or employment (62%), a recent Reuters poll found that only 23% of Americans know that federal LGBTQ+ protections haven’t been enacted yet. Given the high popularity of the Equality Act, and the even higher need for its invaluable protections, Congress must finally pass this vital civil rights bill into law. The lives of LGBTQ+ men, women, and children across the United States are at stake.

Samuel Shepard graduated from Boston University School of Law in May 2020.

Samuel Shepard graduated from Boston University School of Law in May 2020.

Time to Hang up the Boxing Gloves? The Fight Over the Johnson Amendment

Most Americans have never heard of the Johnson Amendment, never mind the nearly 70 year legal and political battle over its meaning and reach. What is the Johnson Amendment, and why is it so important to so many organizations that they have been either trying to protect or destroy it for decades? This post will attempt to explain the long-fought political battle over the Johnson Amendment.

The Johnson Amendment prohibits not for profit, or 501(c)(3), organizations from participating in politics, including restricting them from endorsing political candidates. In 1954, then-Senator Lyndon B. Johnson sponsored the amendment to the tax code after two tax-exempt organizations opposed his candidacy in the recent Texas primary. Until then, tax-exempt organizations had been extremely engaged in political activity through the country. The Johnson Amendment was relatively successful in getting tax-exempt organizations from being politically engaged, at least directly. Many organizations, however, simply have separate political branches called 501(c)(4) political action branches.

Recently, Amendment opponents, such as Congressman Steve Scalise (R-La.) and 40 other Republican Representatives, have introduced the Free Speech Fairness Act. This bill seeks to amend the Internal Revenue Code of 1986 “to allow charitable organizations to make statements relating to political campaigns if such statements are made in the ordinary course of carrying out its tax-exempt purpose.”—effectively repealing the Johnson Amendment. If passed, it will permit 501(c)(3) tax-exempt organizations under Section 501(c)(3) to endorse or oppose political candidates without fear of losing their tax-exempt status.

Supporters of the Johnson Amendment are varied, including both secular and religious organizations. The most outspoken supporter of the amendment is the Freedom From Religion Foundation (FFRF). The FFRF and other similar organizations fear repealing the Johnson Amendment would blur the traditional line between church and state. Other religious organizations, such as the Jewish Federations of North America, oppose the FSFA because they fear getting involved with politics would tarnish the integrity of their faith. Many of these organizations, particularly the FFRF, are especially concerned about the threat of “dark money” they fear repealing the Johnson Amendment would create. “Dark money” refers to political spending by nonprofit organizations that are not required to disclose their list of donors to the IRS or the public. This hidden list of donors can be problematic as many believe this allows nonprofit organizations to receive donations in exchange for political endorsements, influence in elections, and lobbying activities. Specifically, all 501(c)(3) nonprofits, except for churches and other religious organizations, must submit Form 990 to the IRS and demonstrate how they are spending their money and how much money they are receiving (though it does not require disclosure of who the donors are). Because churches do not need to submit this form, the Freedom From Religion Foundation and other opponents of the FSFA fear the bill could lead to churches becoming unregulated Political Action Committees.

Many conservative and religious organizations, on the other hand, support the FSFA. Its biggest proponents are religious organizations such as the National Religious Broadcasters (NRB), as well as conservative organizations like the Family Research Council (FRC). The Johnson Amendment has also garnered attention from President Trump, who has promised on many occasions to eliminate it due to its restrictions on free speech for priests, pastors, and other religious organizations. These groups, the sponsors of the FSFA, and the President argue the Johnson Amendment is unconstitutional because it stifles free speech, including the ability of religious figures and organizations to openly endorse or oppose individual political candidates from the pulpit. Some groups, like the Family Research Council, even argue the Amendment restricts the content of sermons as well, a claim made in an article titled “Figures of (Free) Speech,” published on February 4, 2019, which has since been taken off of the Family Research Council website.

However, is this argument an accurate representation of the law? Does the Johnson Amendment actually stop religious leaders from preaching on topics like “life or marriage” or of “conscience and convictions,” as the Family Research Council claims? The answer seems to be no. The Johnson Amendment does not restrict churches from discussing social or moral issues with their congregations, or even from lobbying Congress. The only restriction the Johnson Amendment imposes is specifically related to candidate endorsements and/or candidate opposition. Moreover, individual priests and pastors are actually free to endorse candidates when they do so as individuals, on their own, when they are clearly speaking as private citizens and not for their religious organization.

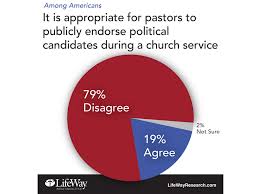

Beyond the organizations who are vehemently opposed to the FSFA, a LifeWay poll published in 2016 found that 79% of Americans do not believe it is appropriate for pastors to endorse political candidates during a public church service.

This, therefore, begs the question, is the repeal of the Johnson Amendment really worth fighting for year after year? Not only do the constant attacks against the amendment cost pro-Johnson Amendment organizations like the FFRF money in time and labor expended through research and lawsuits, but it similarly costs opponents of the amendment valuable donation dollars that could be put towards something more meaningful or substantial.

This, therefore, begs the question, is the repeal of the Johnson Amendment really worth fighting for year after year? Not only do the constant attacks against the amendment cost pro-Johnson Amendment organizations like the FFRF money in time and labor expended through research and lawsuits, but it similarly costs opponents of the amendment valuable donation dollars that could be put towards something more meaningful or substantial.

In 2012, Pew Research published an independent guide to the IRS rules on political activity by religious organizations. The Pew Research guide “Preaching Politics From the Pulpit: 2012 Guide to IRS Rules on Political Activity by Religious Organizations” delineates specifically what religious organizations legally can and cannot do within the context of the Johnson Amendment. According to the guide, the political campaign intervention prohibition does not restrict the discussion of any issues desired, as long as they are not linked to supporting or opposing any specific candidates, PACs, or political parties. It therefore seems that the potential gains for the freedom of speech from this bill passing would be very little compared to the thousands of dollars wasted each year on both sides of the fight on this issue.

Finally, not only is the purpose of the bill not supported by the American public, but the concerns raised by opponents of the bill are especially troubling and should certainly make everyone question whether repealing the Johnson Amendment will ultimately do more harm than good. The separation of church and state is a foundational principle of our nation, and beyond the need to protect that balance, the concern organizations like FFRF have about the potential for dark money in religious institutions seems a valid concern, particularly because they do not submit Form 990.

Ultimately, lawmakers in Washington will need to decide whether it is worth continuing to introduce this bill every year and cost both sides of the argument time and money either trying to fight or support the repeal of the Johnson Amendment.

Kate Lipman anticipates graduating from Boston University School of Law in May 2021.

Kate Lipman anticipates graduating from Boston University School of Law in May 2021.

The Comprehensive CREDIT Act: Taking Down Credit Barriers

A pivotal financial moment, like finding a new job, buying a home, or taking out a student loan, a person's credit history can become an obstacle to achieving what they want to do. Though credit reports and scores can be effective in determining whether to lend money to a borrower, they also tend to dictate where people can work or live. The Comprehensive Credit Reporting, Enhancement, Disclosure, Innovation, and Transparency Act (“Comprehensive CREDIT Act”) would change who could use a consumer’s credit information to make determinations and what impact, and for how long, other factors could have on one’s score. Congress should enact this bill. Not only is the Fair Credit Reporting Act (“FCRA”) outdated, but credit scores also tend to perpetuate discriminatory behaviors.

Credit Reports and Scores

A credit report provides a history of a consumer’s credit activity, including bill payments, current statuses of credit accounts, and adverse records like foreclosures, bankruptcies, and civil judgments. Credit reports also provide personal information like addresses, points of contact, and the consumer’s social security number. Three companies dominate the credit reporting industry: Equifax, Experian, and TransUnion. Though they never receive a consumer’s outright consent to compile personal data, these three private companies are the main credit report providers. If there are errors on the credit report, the consumer (1) must have access to a credit report or find out about the error another way; and (2) notify the credit reporting agency rather than the creditor that reported the error. Once the consumer has done this, the credit reporting agency’s duties are triggered.

A credit score is an assessment of how likely it is a consumer will fulfill a debt obligation on time. Several factors go into determining a credit score: payment history, current debts, the types and number of accounts one currently has, how long those accounts have been open, and issues like debt collection or bankruptcy. Each of these factors, which are of varying weights, are used in a private company’s “scoring model” (i.e., a formula) to concoct a three digit number. Scores generally range from 300-850; the closer to 850, the more “creditworthy” a consumer is. Though credit reporting companies have disclosed generally which factors compose a credit score, they refuse to disclose the entire scoring model. Indeed, most use trade secret laws as a shield. Without disclosing the scoring model, credit reporting companies can engage in retaliatory and discriminatory behaviors. For example, predatory lending leads to Black and Hispanic homeowners to have higher mortgage payments. Because of historical racist policies leading to lower credit scores and less wealth among these populations, they are also more at risk of not being able to keep up with payments. The discrimination therefore feeds itself: borrowers with lower credit scores end up with even lower scores because of missed payments and foreclosures.

Who Uses Credit Scores?

Financial institutions are the biggest credit score users. Credit scores help them determine whether they should allow a consumer to obtain a line of credit or home mortgage, for example. The other major context where credit scores are important is employment. Employers conduct credit checks as part of a background check process. They usually look at the consumer’s entire credit report, not just her score. One argument is that if an individual is not “trustworthy” enough to make payments on time, they may not be trustworthy on the job, either. In certain positions, such as those involving accounting, this information would matter. But for most positions, the association between trustworthiness and creditworthiness can have prejudicial effects. (One study found that those with lower credit scores tend to have more “agreeable personalit[ies],” if anything.)

Comprehensive CREDIT Act

In January 2020, Congresswoman Ayanna Pressley (D-Mass.) introduced the Comprehensive CREDIT Act. The Comprehensive CREDIT Act, which amends the FCRA, proposes several reforms: (1) allowing for easier processes to fix credit report errors; (2) restricting use of credit scores for hiring and employment purposes; (3) providing relief for student loan borrowers with poor credit; (4) medical debt reporting wait times and bans for medically necessary procedures; and (5) reducing the amount of time adverse credit information remains on one’s credit report. Predictably, the House voted along party lines and passed the bill. However, it is now awaiting action in the Senate.

The chief reform involves what factors impact a consumer’s credit score. The Act proposes removing certain types of late payments, like student loan and medical bill payments. For the remaining delinquent or negative information, the reporting periods are shortened. For example, if an individual files for bankruptcy, the bankruptcy can appear on a person’s credit report for seven to ten years. Under the Act, the period would be shortened to four to seven years. The Comprehensive CREDIT Act also requires that when there are discrepancies in reports provided to the consumer and the requestor, those discrepancies must be explained to the consumer.

The bill also addresses credit score use for employment screening. The bill prohibits employers from denying an applicant solely because of her credit score. The bill may not go far enough, though: the employer can still request the information, and the job applicant can approve its use. While the employer’s decision cannot be made based on that information, they will nevertheless still have access to it.

The bill’s opponents say that the proposed reforms will undermine confidence in credit scores, which are integral to our financial system. By softening the impacts some credit events have, a creditor may not have the full picture of an individual’s ability to pay. The effects could harm more consumers than protect them, as riskier activity may go unreported or not have as much as a determinative effect. To be sure, credit scores are a pillar of our financial system. Any change to them will have a significant impact on how the financial impact operates. Even so, credit scores continue to have a discriminatory effect on certain communities of borrowers and only perpetuate disparate impacts. Rep. Pressley’s bill focuses largely on that impact. The purpose of the bill is to minimize the impact of credit-related issues. A credit report currently only provides a black and white picture a person’s debts and credit history; a credit score is a numeric representative of that history. It does not show that a medical debt incurred was for a life-saving procedure or that a foreclosure stems from a predatory lending process. The impacts of those events stay with the creditor for some time, further impacting their lives even though they have overcome the event. For example, a poor credit report tip the scales in favor of other candidates, especially for competitive positions.

The COVID-19 pandemic is already creating significant financial implications. Inabilities to pay credit card bills because of unexpected income losses will affect consumers for years to come, even when the financial system recovers. Because so many Americans live paycheck-to-paycheck, and because COVID-19 was largely unplanned for, consumers should not have to face the consequences. Provisions in Rep. Pressley’s bill would remedy some of those concerns. Now is clearly the time to enact the Comprehensive CREDIT Act.

Kathryn Buckley anticipates graduating from Boston University School of Law in May 2021.

Kathryn Buckley anticipates graduating from Boston University School of Law in May 2021.

Electric Scooters and Data Reporting: A Roadmap to Smart Development

In many cities electric scooters appeared virtually overnight. These new forms of transportation have many benefits including: decreasing carbon emissions, making public transit more accessible, and solving first/last mile issues. Scooters also exacerbate many issues facing urban planners: taking up space on sidewalks, scaring pedestrians, increasing congestion, and may decrease public transit revenues. As state and municipal authorities scramble to regulate this new popular transportation mode, they should also embrace the benefits. A needed first step is to repurpose the Transportation Network Companies (“TNCs”) data reporting requirements to gather similar data from electric scooter companies.

In some cities TNCs, such as Uber and Lyft, contributed roughly 50% to congestion increases in the past several years. As a result, many cities and states have implemented reporting requirements on TNC’s in order to better understand their impact. In February 2019, New York City conditioned operating within the city to the disclosure of ride-share data. Now in New York City, TNCs must report: (1) where each passenger is picked up; (2) the time each passenger is picked up; (3) the total number of passengers; (4) the location where each passenger is dropped off; (5) the time each passenger is dropped off; (6) the total trip mileage; and (7) the cost of the trip. Seattle requires TNC’s to report : (1) the total number of rides provided; (2) percentage of rides completed in each zip code; (3) pick-up and drop-off zip codes; (4) percentage of rides requested but unfulfilled; and (5) collision data.

This data provides many benefits for municipal authorities. First, it allows them to better understand where trips start and end, and at what time the trips are occurring. With this information, authorities can increase and/or decrease existing public transit routes to meet demand, can extend public transit options to reach underserved areas, and adjust infrastructure to facilitate travel trends and tendencies. Public officials argue that when rider needs are better understood and this data put to an effective use, TNCs can be integrated with public transportation systems to make private car ownership obsolete, and vastly reduce traffic congestion. In turn, this would mean more efficient roads and more space for development. Additionally, less traffic would correspond to less damage on existing infrastructure, thereby opening up funding for other projects public transportation.

For example in 2018, Washington D.C., through their TNC data collection, noted that TNC usage matched transit commute patterns closely during the week, but also that TNC usage significantly increased in the evenings and weekends. In 2019, the Washington Metro proposed several potential changes to their operating hours, including significant increases to the number of service hours during nights and weekends. These changes are likely a response to insights gained from TNC data collection.

TNCs and electric scooters are similar in many regards. Electric scooters also provide an alternative transportation option that can either replace or supplement public transit. Electric scooter use can also highlight traffic trends and shed light on infrastructure and public transportation needs. For example, a study of an electric scooter pilot program in Portland, OR noted that 19% of all electric scooter trips occurred between 3 p.m. and 6 p.m. on weekdays, mirroring traditional rush hours. This finding parallels the findings of data collected by Washington D.C. from TNCs.

Because TNCs and electric scooters pose similar problems and could provide similar data, they should be subject to similar reporting requirements. Moreover, these requirements would not be difficult to implement as electric scooters are already GPS tracked and companies already routinely collect the data sought.

Further, this data collection could benefit the electric scooter industry. The Portland pilot program predictably discovered (1) 0% of electric scooters rode on the sidewalk when riding on a street with a neighborhood greenway; (2) 8% of electric scooter users rode on the sidewalk when riding on a street with a protected bike lane; (3) 21% of electric scooter users rode on the side walk when riding on a street with a bike land; and (4) 39% of electric scooter users rode on the sidewalk when riding on a street with no bike facilities. Consequently, Portland could, using this information and additional data about popular scooter routes, construct additional bike lanes in high scooter traffic areas to facilitate a safer commute for riders. Electric scooter data could also help municipalities determine when to increase or decrease public transit availability. If data shows a hotspot for the origination or termination of rides, authorities may even use this data to decide to expand public transit service to a previously unserved area.

Lastly, this data needs to be made available to any interested governmental entity. Although San Francisco has been plagued by TNC congestion the California Public Utilities Commission, which collects TNC data, has been reluctant to share this information with municipalities. San Francisco is unable to make informed policy decisions; regarding both TNCs and public transit generally, without this information. This hoarding of information must not happen with the data collected from electric scooters.

When regulating electric scooters, as many states and municipalities are beginning to do, they should consider requiring electric scooter companies to report on information regarding (1) passenger pickup location; (2) pick up time; (3) passenger drop off location; (4) drop off time; and (5) the total trip mileage. This information alone would give these authorities some of the data they need to better implement future transportation and municipal planning policies.

Graham (Gray) Louis anticipates graduating from Boston University School of Law in May 2021.

Graham (Gray) Louis anticipates graduating from Boston University School of Law in May 2021.

Massachusetts Regulates Short-Term Rentals

Massachusetts’s Governor Baker signed An Act Regulating and Insuring Short-Term Rentals on December 28, 2018. The act regulates short-term rentals provided through services like Airbnb. The governor rejected an earlier version of the bill, and returned amendments primarily allowing for an exemption for owners who rent out their property for two weeks or less per year, and reducing the amount of information provided publicly about rentals owners. The bill was motivated by concerns that the rise in short-term rentals drives up housing costs and pushing out long-term residents. The statewide bill comes after both Boston and Cambridge individually passed laws essentially having the same effects. However, the Boston law was challenged by Airbnb, who filed suit in federal court claiming that the regulations are “Orwellian” and violate several laws, including laws that protect online companies from being held liable for the actions of their users. The city of Boston is currently holding off on some of the regulations passed pending the resolution of the court case. Airbnb had not yet said if it will challenge the new Massachusetts law.

The statewide law has two main components: first, that all short-term rentals are taxed by the Commonwealth, and can be additionally taxed by local governments, and second, that all owners of short-term rental properties must register with the state and hold insurance. The registration requirement was a cause of debate.  Lawmakers, including Governor Baker, were concerned about violating the privacy of owners by publishing their names and addresses publically. In the amendments to the July bill that Governor Baker rejected, the registration requirement was changed so that only the owner’s neighborhood and street name would be published, not their exact address. The law also dictates eligibility in order to register. To be eligible to be a short-term housing unit, the space must be compliant with housing code, be owner-occupied and be classified for residential use, among other requirements. Another cause of debate was an exemption for occasional renters. Governor Baker originally wanted owners who rent their properties for 150 days or less to be exempt from the regulations. However, in the final version of the bill, the exemption was decreased to 14 days.

Lawmakers, including Governor Baker, were concerned about violating the privacy of owners by publishing their names and addresses publically. In the amendments to the July bill that Governor Baker rejected, the registration requirement was changed so that only the owner’s neighborhood and street name would be published, not their exact address. The law also dictates eligibility in order to register. To be eligible to be a short-term housing unit, the space must be compliant with housing code, be owner-occupied and be classified for residential use, among other requirements. Another cause of debate was an exemption for occasional renters. Governor Baker originally wanted owners who rent their properties for 150 days or less to be exempt from the regulations. However, in the final version of the bill, the exemption was decreased to 14 days.

Not surprisingly, the hotel industry supports the bill. Paul Sacco, the President and CEO of Massachusetts Lodging Association, said:

“This is a tremendous victory for municipal leaders and the people of Massachusetts who have been waiting for years while Airbnb rentals have exploded, resulting in skyrocketing housing costs and disruptions in local neighborhoods. By adopting a more level playing field between short-term rentals and traditional lodgers, lawmakers made great strides toward a more fair and sensible system.”

Airbnb had a far less enthusiastic response however. In citing concerns about the property owners who use Airbnb to earn extra income, Airbnb said that they would “continue the fight to protect our community and the economic engine of short-term rentals for hosts, guests, and local small businesses”

While Massachusetts is the first state to pass a law, many other cities have passed similar laws in the recent years. In Nashville, the city passed a law in January which focused on taxing short-term rentals that are not owner-occupied in order to fund affordable housing development in the city. The “linkage fee” tax is controversial, with lawmakers questioning if the fees generated are enough to actually impact the lack of low-income housing within the city. Seattle passed a similar tax law in November 2017. The legislation aims to encourage owners who rent out a spare bedroom and discourage investors who buy entire buildings for use as short-term rentals. Finally, New York City passed regulations in July 2018 which requires Airbnb, and other similar companies, to provide information about the properties listed for rental within the city. However, Airbnb sued in federal court claiming that the requirement to provide information to the city violated the company’s fourth amendment right against search and seizure. The law was set to take effect in February 2019, however the Judge granted a preliminary injunction in favor of Airbnb saying, “The city has not cited any decision suggesting that the government appropriation of private business records on such a scale, unsupported by individualized suspicion or any tailored justification, qualifies as a reasonable search and seizure.”

Jessica A. Hartman is a member of the Boston University School of Law Class of 2020.

Jessica A. Hartman is a member of the Boston University School of Law Class of 2020.

Raising the Blinds – Gaining Meaningful Insight into Pharmaceutical Pricing through Legislation

Rising healthcare costs are a growing concern across the United States; in 2016 U.S. health care spending was $10,348 per person – or 17.9 % of the nation’s Gross Domestic Product (GDP). To counter this alarming rise in healthcare costs, states are addressing one of the largest factors in rising healthcare costs – high drug prices.

Many factors contribute to the high price of healthcare in our country, some of which are natural to an aging populace due to the baby boom of the 1950’s as the proportion of the population that is 65 and over is projected to experience a large increase in the coming years. An increase in costs is natural with a larger number of consumers – addressing this change is an important, but avoidable, challenge to overcome.

One avoidable factor of increasing healthcare costs is rapidly increasing pharmaceutical prices. Variance in drug prices may be geographic; based on where the drug is sold , or whom the drug is being sold to (pharmacy v. government). Many factors contribute to price differences, but an important factor are Pharmacy Benefit Managers (PBMs) as an intermediate in the market. States have been working to roll back the PBM layer of the market for the pharmaceutical industry.

Pharmaceutical pricing has long been the target of legislators, but with a lot of talk and a surprising lack of action. Drug pricing is discussed in both major party’s campaign platforms of the major parties and has been featured prominently in speeches by President Trump, and has featured in initiatives by previous administrations. There has been an uptick of legislation passed in the past decade, at all levels of government, with state action against pharmacy benefit managers and President Trump’s signing the Know the Lowest Price Act and the Patient Right to Know Drug Prices Act. A common thread in the legislation is increased transparency because a big factor in the high drug prices — and medical care generally—is the lack of information for consumers and purchasers. Since 2015, California, Oregon, Louisiana, Nevada, Vermont, Connecticut, and Maryland imposed reporting requirements on pharmaceutical manufacturers who increase prices over an established threshold in a set time period. For example, California requires reporting when a drug that costs more than $40 and its wholesale acquisition cost (WAC) increases by more than 16% over two calendar years. The WAC is similar to a “list” price for pharmaceuticals to wholesalers and direct purchasers. The WAC, however, does not include discounts or rebates offered by pharmacy benefit managers.

The new transparency offers insight to price increases; if there are no legitimate reason for the increase other than higher profits due to market control, state officials, drug customers and the public can take action.

The states with transparency statutes have imposed different methodologies with manufacturers reporting to different government officials such as the Department of Health and Human Services, creation of new departments, or to the state’s Attorney General.

Oregon currently requires the most detailed reporting; manufacturers must report to the Department of Consumer and Business Services the following:

- Name, price of drug and net increase in price (in %) over previous calendar year

- Length of time on market

- Factors contributing to price increase

- Name(s) of any generic version(s) of the drug

- Research & Develop Costs from Public Funds

- Direct costs to Manufacturer

- Total sales revenue for drug over prev. calendar year

- Profit from drug over previous calendar year

- Drug's price at release and yearly increases over the past 5 years

- 10 highest prices paid for the drug during past year outside of the US

- Any other info relevant to price increase

- Supporting documentation

In contrast, California’s requirements provide for advance notice of price increases and unearthing the reasoning for the increase. The California law requires manufacturers to report (A) Date of increase, current WAC, and future increase in WAC (in dollar amounts); and (B) The change or improvement, if any, that necessitates the price increase. Purchasers then have notice of any forthcoming price changes and if the increase is warranted. California also requires a report for new drugs if its price exceed $670—the 2017 Medicare Part D threshold. California’s reporting scheme has been a model for other states.

Maryland’s approach was more severe, with a provision banning “price gouging” of generic drugs. An “unconscionable price increase” of any “essential off-patent or generic drug” is illegal and Maryland can levy a fine and take action to reverse the price change. The state did not include any limitation of the law to drugs that have come into or passed through Maryland.

The generic drug lobby, the Association for Accessible Medicines, challenged the law and the Fourth Circuit Court of Appeals struck down the law as an unconstitutional regulation of interstate commerce. Maryland has petitioned the Supreme Court to revisit the case.

The Pharmaceutical Research and Manufacturers (PhRMA), one of the largest pharmaceutical lobbying groups, has sued California alleging the law, like Maryland’s, is unconstitutional. Because California’s law is informational—and does not allow forced price changes—it is likely constitutional. In fact, PhRMA’s initial complaint was dismissed, and subsequently filed an amended complaint on Sept. 18, 2018.

The Pharmaceutical Research and Manufacturers (PhRMA), one of the largest pharmaceutical lobbying groups, has sued California alleging the law, like Maryland’s, is unconstitutional. Because California’s law is informational—and does not allow forced price changes—it is likely constitutional. In fact, PhRMA’s initial complaint was dismissed, and subsequently filed an amended complaint on Sept. 18, 2018.

It will be imperative for states seeking to regulate pharmaceutical manufacturers to observe where courts determine the extent of reporting they may require when they go after a manufacturer for increasing the price of their drug. For the time being, it appears that information-gathering may be the easiest available avenue for states seeking to curtail increases in drug prices. Seeking justifications and reasoning for large increases in drug prices may create a barrier for pharmacuetical companies seeking to impose unsubstantiated increases in drugs. Going further towards affirmative control of pricing appears to be off limits to states going as far as Maryland, but more careful structuring of the controls to the specific state may be permissible.

Drew Kohlmeier is a student in the Boston University School of Law Class of 2020 and is a native of Manhattan, KS, graduating with a degree in Biology from Kansas State University in 2016. Drew decided on Boston for law school due to his interest in health care and life sciences, and will be practicing in the emerging companies space focused on the life sciences industry following his graduation from BU.

Drew Kohlmeier is a student in the Boston University School of Law Class of 2020 and is a native of Manhattan, KS, graduating with a degree in Biology from Kansas State University in 2016. Drew decided on Boston for law school due to his interest in health care and life sciences, and will be practicing in the emerging companies space focused on the life sciences industry following his graduation from BU.