Category: Local Legislation

Running Out of Room: The Right to Shelter in Massachusetts

On August 8, 2023, Massachusetts Governor Maura Healey declared a state of emergency because state resources were insufficient to comply with the Commonwealth’s right to shelter law. Although the law has been in place for 40 years, a rapid increase in the number of people requesting shelter and the declaration of a state of emergency has inspired new debates and tensions around the right to shelter. To maintain the spirit of the law but not overburden the Commonwealth, compromises must be made to continue the legacy of the right to shelter.

Governor Dukakis & Right to Shelter

In 1983, Massachusetts closed its mental hospitals, which along with rising drug use, left people homeless and sleeping in the streets across the state. In response, Governor Michael Dukakis filed legislation guaranteeing shelter for every homeless family in the state. Ten months later he signed the ‘right to shelter’ law.

The emergency assistance program, colloquially known as the right to shelter law, is meant to protect children from homelessness if their parents fall onto hard times. The law guarantees shelter for families with children and pregnant people without children. Under the law, the state must quickly provide shelter and basic necessities to families who have nowhere else to stay.

Governor Healey & Current Crisis

On July 31, before the state of emergency, a group of Massachusetts legislators released a letter urging the federal government to streamline the process for work authorizations so immigrants can begin working and stop depending on the state. Employment authorization had a wait time of six months or longer, thus forcing immigrants to rely on the state as they cannot legally work without authorization.

On August 8, Governor Healey declared a state of emergency after months of rapid escalation of families seeking shelter. Along with the state of emergency, the state reported spending nearly $45 million per month on programs to help families eligible for emergency assistance. As of October 2023, nearly 7,000 families were in emergency shelter and about half of those in shelter were children. The governor said the state would be unable to accommodate new families by the end of October 2023. Despite the inflated numbers and costs, the governor made it very clear that the law was not ending, but Massachusetts needed federal assistance, sites to house people, staffing, and funds to continue doing the work of sheltering those in need.

Massachusetts is the only state that has a right to shelter. The most similar law is a New York City consent decree that guarantees all unhoused individuals—not just families—shelter within city limits. The city’s right to shelter law has also been facing criticism as an increase in unhoused people and an influx of immigrants has overburdened that system as well. In response to the surge of families seeking shelter, New York City Mayor Adams suspended some components of the law, Governor Kathy Hochul declared a state of emergency, and subsequently received $104.6 million federal funds in response. Much like what happened in New York City, Mayor Healey is attempting to solicit federal assistance to mitigate the rapid increase in those seeking shelter and the amount of state resources being allocated to handling the crisis.

Massachusetts is the only state that has a right to shelter. The most similar law is a New York City consent decree that guarantees all unhoused individuals—not just families—shelter within city limits. The city’s right to shelter law has also been facing criticism as an increase in unhoused people and an influx of immigrants has overburdened that system as well. In response to the surge of families seeking shelter, New York City Mayor Adams suspended some components of the law, Governor Kathy Hochul declared a state of emergency, and subsequently received $104.6 million federal funds in response. Much like what happened in New York City, Mayor Healey is attempting to solicit federal assistance to mitigate the rapid increase in those seeking shelter and the amount of state resources being allocated to handling the crisis.

Debates Over Right to Shelter

Since the beginning of 2023, there has been increased criticism of the right to shelter in Massachusetts. People claim the housing crisis paired with the surge of immigrants entering the state have overburdened the emergency assistance system. Further, they claim the right to shelter has turned Massachusetts into a ‘migrant magnet.’ Overall, critics see the right to shelter as an outdated relic that cannot keep up with current demands. These criticisms have come with calls for the law to be amended, suspended, or altogether repealed.

Rep. Peter Durant (R-Worcester), is among the most vocal in expressing criticisms of the right to shelter law. Durant firmly believes the right to shelter law is being overrun by migrant families asking for assistance and suggested adjusting the law to excluding immigrants from receiving aid under this law. On September 14, 2023, Durant proposed H.4561 (An Act Ensuring Fair Housing for Homeless Families) to amend the right to shelter law to only apply to U.S. citizens. He is joined by twelve other petitioners, and the bill is still in committee as of October 2023.

Despite the criticism, there is still sizable support for the law amidst the crisis. Sarang Sekavat, chief of staff at Massachusetts Immigrant and Refugee Advocacy Coalition, testified, “The idea [of the law] has always been to help out families and really to make sure that children aren’t suffering when their parents fall on hard times, and that’s exactly what we’re seeing right now.” 76% of Massachusetts residents, especially immigration and housing advocates, agree with Sekavat and believe the law is operating exactly as it was meant to and exemplifies the character of Massachusetts.

Moving Forward

Although the current housing crisis is putting the right to shelter law under intense scrutiny, the law is functioning as intended. The law was passed with children in mind and with the goal of ensuring no child had to sleep on the streets of Massachusetts. There is a rising need for housing, influenced by the housing and immigration crises, and many children do not have housing. The law has been an important part of Massachusetts’ identity for four decades, and to repeal it now when people need it most would be to go against the very nature of the Commonwealth.

On the other hand, concessions may need to be made for the well-being of the Commonwealth. If the Commonwealth overextends itself and its resources to meet rising needs, it may jeopardize the longevity of the right to shelter and similar programs. In 1983 there was no way to predict the amount of people seeking shelter in 2023. Now, there is no way to predict the trends in people seeking shelter, particularly if it will continue to increase or when it will stop. If Massachusetts will run out of room imminently, difficult decisions must be made to address the need for shelter with the availability of resources and housing.

The path forward must be a mix of aspiration and reality. Massachusetts must solicit support from the federal government with financial assistance and an expedited process for work authorizations. Further, Massachusetts must look inward to equitably share the responsibility among all towns and cities, as well as plan to increase the housing available for those in need. Additionally, the Massachusetts Legislature could pass legislation to address the housing crisis, including implementing rent caps and moratoriums on evictions. To continue the legacy of the right to shelter law, the Massachusetts and federal governments must work together to address the current crisis and preserve the law for those who need it in the future.

Juliana Hubbard anticipates graduating from Boston University School of Law in May 2025.

Juliana Hubbard anticipates graduating from Boston University School of Law in May 2025.

Massachusetts Broker’s Fees: Reasonable Service or Market Manipulation?

In 2023 Massachusetts established the Executive Office of Housing and Livable Communities with an eye toward creating more housing in the state, which, like many across the country, is suffering a housing shortage. Some estimates suggest that Massachusetts will require between 125,000-200,000 additional housing units by the end of the decade. Various proposals are currently being considered as how to best spur the creation of new homes. The eventual solution will not be a single provision but likely many policy amalgams from various sectors. One proposal currently before the Joint Committee on Housing is Senator James B. Eldridge’s bill, An Act Enabling Local Options for Tenant Protections (Bill S. 872). One of the more quietly influential provisions in the bill, Section 8(g),[i] should be amended to be mandatory across the state, rather than allowing municipalities to opt into the provision and the language regarding should be changed to prohibit the business from charging tenants a fee. Any of the various similar bills that the committee is considering should adopt Section 8’s amended language.

Section 8(g) could alone reduce the cost of relocating to a new apartment by almost 20%, greatly increasing the mobility of Massachusetts tenants, and concomitantly, increasing the competitive demand for more, new housing units. The bill allows municipalities, to prohibit tenant-paid broker fees. Currently, tenants relocating in the Commonwealth may be required to provide first month’s rent, last month’s rent, a security deposit, and a broker’s fee at signing. Security deposits and broker’s fees are traditionally tied to the price of the housing unit and often are equivalent to one month’s rent. The median rental price for a one-bedroom apartment in Boston (certainly the state’s most expensive large housing market) is above $2,900, meaning that a renter must find $11,600 to move—likely before they’ve received their previous security deposit back.

The remainder of the bill provides for municipalities to adopt, should they so choose, rent stabilization regulations, standards for just cause eviction protection, condominium conversion ordinances, prohibitions on immediate rent increases in response to the bill, anti-gentrification displacement protections, and regulations of fees. Each provision has its merits and deserves its own full analysis not available in this article.

While the bill before the Housing Committee allows for different municipalities to adopt different policies, the state’s goal of new housing would be better served by prohibiting the practice of broker's fees. In the modern housing market, tenants are often looking for units through online platforms and only being connected with brokers after inquiring into specific properties. However, nothing prevents multiple brokers from presenting the same listing because landlords can provide their listing to multiple brokers. Under such a model prospective tenants must pay the vendors that their landlord contracted with, making renters captive consumers, which distorts natural market forces and contradicts the needs of the broader housing market and tenants’ interests.

Other cities and states have recently tried to put forward similar provisions to varying results. Often such proposals face significant pushback from broker-related interest groups. The housing market inefficiency is a case study in the challenge of making reforms in circumstances of concentrated interests and diffuse costs. While renters may feel aggrieved about their new apartment costs, they likely only face the additional expense no more frequently than once per year. Meanwhile, brokers reap substantial benefit from a captive market and thus have every incentive to ensure no progress or changes are made to their outdated role in a modern market. The housing shortage allows landlords to deflect the cost onto tenants because tenants have so little choice in the current shortage; thus, no competitive price pressure, by either landlords or tenants, are exerted on brokers to provide competitive fees or better services.

Broker groups have suggested that prohibitions on tenant-paid fees will increase rents by requiring landlords to cover the costs. They are likely correct; though it is likely of little consequence. Assuming that the one-month’s-rent broker fee is a competitively derived price for services rendered and assuming that brokers are actually required in modern apartment leasing (two generous assumptions): if a landlord is instead required to pay the $2,900 broker fee for a broker finding a tenant for a median one-bedroom Boston apartment, we could expect that they would raise the rent of the apartment by as much as $247.44 (spreading the $2,900 expense with 5% annualized interest over 12 monthly payments), an 8.5% increase. While an 8.5% increase in rent sounds substantial, (all assumptions holding constant) the tenant’s housing costs over the same first twelve months has increased only 0.002% while the cost of relocating has decreased by 18.6%. The substantial reduction in cost to relocate to a new apartment (which, albeit, doesn’t include moving expenses, i.e. boxes, truck rental, moving company, favors and pizzas for friends) increases tenants’ ability to more successfully exert their demand force as consumers, which requires the market to respond proportionately, through a reduction in rental costs or an increase in the quality or quantity of housing.

Broker groups have suggested that prohibitions on tenant-paid fees will increase rents by requiring landlords to cover the costs. They are likely correct; though it is likely of little consequence. Assuming that the one-month’s-rent broker fee is a competitively derived price for services rendered and assuming that brokers are actually required in modern apartment leasing (two generous assumptions): if a landlord is instead required to pay the $2,900 broker fee for a broker finding a tenant for a median one-bedroom Boston apartment, we could expect that they would raise the rent of the apartment by as much as $247.44 (spreading the $2,900 expense with 5% annualized interest over 12 monthly payments), an 8.5% increase. While an 8.5% increase in rent sounds substantial, (all assumptions holding constant) the tenant’s housing costs over the same first twelve months has increased only 0.002% while the cost of relocating has decreased by 18.6%. The substantial reduction in cost to relocate to a new apartment (which, albeit, doesn’t include moving expenses, i.e. boxes, truck rental, moving company, favors and pizzas for friends) increases tenants’ ability to more successfully exert their demand force as consumers, which requires the market to respond proportionately, through a reduction in rental costs or an increase in the quality or quantity of housing.

The flaw in such an analysis is the omission of any future years’ rents based off the initial absorption of the broker fee. That is to say, even assuming the rent does not get raised after one year, the tenants will be paying that additional $247.44 each month of every year after the first. So over two years the housing costs would increase by 4.2%. It is worth noting however, that the two listed assumptions are not the legal reality in a number of competing states. Accordingly, any such reactionary rise in rent prices is not a given, and certainly not an increase of 8.5% as discussed above. Additionally, such a calculus does not consider the prohibition on immediate rent increases elsewhere in Senator Eldridge’s bill. Nor does it account for other provisions not yet proposed. For instance, California does not allow landlords to request or accept last month’s rent, and the justification for continuing to require Massachusetts residents to makes increasingly little sense in the present shortage.

The current fee-shifting model onto tenants provides perverse and inefficient market incentives for the actors in the field. With inadequate housing stocks, landlords are able to defer screening and application costs onto brokers and are not incentivized to make applying more efficient for tenants. Nor is there substantial incentive to add to or improve the available housing stock. Brokers, because there are is no expectation of exclusivity, have no increasing marginal interest in providing additional efforts to find tenants as another broker may fill a vacancy before they can, especially as most tenants locate apartments through non-broker-affiliated online platforms in the modern market. Nor are brokers incentivized to provide competitive fees as the industry has agreed upon the equivalent of one month’s rent, the price-fixing characteristic central to the economic definition of a cartel.

Meanwhile, throughout the process, tenants have limited selection and face rental prices inflated by the squeeze of the housing shortage. Even tenants who don’t move are harried by the practice as sizable year over year rent increases are unavoidable because of the exclusionary capital required to move elsewhere. Currently, to avoid a rent increase and move requires having on-hand the equivalent of four month’s rent. Which is a cruel absurdity given that 44.5% of households in the Greater Boston area in 2022 were cost burdened according to the Boston Foundation’s Greater Boston Housing Report Card, that is spending more than 30% of their income on rent. The same report showed that nearly half of those cost burdened, 22.7% of households in the Greater Boston area, are severely cost burdened, spending more than 50% of their income on rent. To bind families in a Catch-22 that they cannot seek less expensive housing unless they save the equivalent of four months rent while they are currently paying more than half of their income towards their current rent leaves countless Massachusetts residents teetering at the edge of housing insecurity.

Any adjustment to the current fee scheme, let alone a blanket prohibition on the practice, will activate lobbying efforts from the Massachusetts Association of Realtors, whose End of Session Legal Update in 2022 noted that they “successfully blocked rent control, eviction moratoria, [and] broker fee shifting….” Accordingly, any successful legislation will need to mobilize tenant organizations and various community grassroots organizations to advocate on behalf of lowering relocation prices and diffusing the benefit.

Massachusetts’ housing shortage will require the efforts of policy makers, stakeholders, and community members. The one thing that we can be confident won’t solve the state’s housing shortcomings is not altering the forces that created the problem. The current fee scheme operates as a state-sanctioned cartel that makes relocating markedly more difficult and thus suppresses proper demand and supply influences, further distorting the housing market in the Commonwealth. While it is not a panacea, tenant-paid broker fees should be consigned to the curb with the rest of waste.

[i] “(g) In addition to the powers granted to a city or town in this section and notwithstanding section 87DDD½ of chapter 112, a city or town may by local charter provision, ordinance or by law regulate, limit or prohibit the business of finding dwelling accommodations for a fee.”

Michael St. Germain anticipates graduating from Boston University School of Law in May 2025.

Michael St. Germain anticipates graduating from Boston University School of Law in May 2025.

The Push and Pull of Municipal Fossil Fuel Bans in Massachusetts

In 2019, Brookline, Massachusetts became the first municipality outside of California to ban fossil fuels in new construction. The move was part of a growing movement among cities and towns to ban fossil fuel infrastructure, such as hookups for oil or natural gas use, in newly constructed buildings. Fossil fuel bans of this nature typically aim to curb emissions from energy use in buildings, which in many municipalities is the leading source of emissions, through electrification. Electricity use in buildings produces less carbon emissions than burning oil and gas directly and those emissions will continue to decrease as more renewable resources are added to the electricity grid.

Unfortunately for Brookline, the Attorney General’s Municipal Law Unit disapproved of Brookline’s fossil fuel ban in 2020, finding that the ban was preempted by state law. Not easily deterred, Brookline passed a new set of by-laws in 2021. These by-laws were worded differently than the first attempt, framed as requirements for building permits rather than an outright ban. However, these by-laws fared no better than the first ban, and the Attorney General issued a decision in 2022 once again disapproving of the by-law amendments because they were preempted by Chapter 40A (regulating municipal zoning), Chapter 164 (regulating natural gas), and the State Building Code.

Unfortunately for Brookline, the Attorney General’s Municipal Law Unit disapproved of Brookline’s fossil fuel ban in 2020, finding that the ban was preempted by state law. Not easily deterred, Brookline passed a new set of by-laws in 2021. These by-laws were worded differently than the first attempt, framed as requirements for building permits rather than an outright ban. However, these by-laws fared no better than the first ban, and the Attorney General issued a decision in 2022 once again disapproving of the by-law amendments because they were preempted by Chapter 40A (regulating municipal zoning), Chapter 164 (regulating natural gas), and the State Building Code.

Meanwhile, in the time between when Brookline passed its first fossil fuel ban and when the Attorney General issued its decision about the legality of the second ban, dozens of other Massachusetts municipalities became interested in enacting fossil fuel bans of their own. Some of these municipalities submitted home rule petitions to the Massachusetts legislature, asking the legislature to grant their individual municipalities the authority to ban fossil fuel infrastructure on a case-by-case basis. State Representative Tami Gouveia and State Senator Jamie Eldridge of Acton also introduced a bill during the 2021–2022 session that would have granted every municipality in the commonwealth the power to adopt a requirement for all-electric construction without passing and submitting a home rule petition.

The result was a compromise: The legislature passed An Act Driving Clean Energy and Offshore Wind in August of 2022. The law, among other things, authorized a pilot program enabling up to ten cities and towns to adopt and amend ordinances or by-laws to require new building construction or major renovation projects to be fossil fuel-free. The Massachusetts Department of Energy Resources (DOER) was tasked with developing the pilot program and deciding which municipalities would participate. Among requirements for cities and towns seeking to join the pilot program for fossil fuel bans is having a minimum of ten percent affordable housing.

DOER has already received more than ten applications from Massachusetts cities and towns wishing to join the pilot program, but under the draft regulations DOER published in February of this year, municipalities would have to wait until early 2024 at the earliest to implement their bans. This long period for implementation has disturbed members of the legislature who championed and passed the pilot program into law. Senator Michael Barrett, the Senate Chair of the Joint Committee on Telecommunications, Utilities and Energy recently told GBH News that the proposal would “delay the entire process much longer than the Legislature ever imagined.” Pressure from both the legislature and the municipalities seeking to join the pilot program will likely continue to mount as the group of cities and towns now includes the City of Boston, the largest city in the commonwealth. With advocacy groups concerned that the delay combined with limiting the pilot program to ten municipalities will hold the commonwealth back from meeting its goal of reaching net zero carbon emissions by 2050, legislators may be reconsidering the more conservative approach they took by passing the pilot program rather than blanket approval for cities and towns to enact fossil fuel bans.

Opponents and those concerned about the impacts of fossil fuel bans, however, may be heartened by the delay. Governor Charlie Baker considered vetoing the energy bill because of the fossil fuel ban pilot program because of the possibility that banning fossil fuels in new construction might make it more difficult to build affordable housing. In a state experiencing what many characterize as an affordable housing crisis, this concern is not uncommon, the thought process being that if there is inconsistency in requirements for developers between municipalities, developers, especially developers of affordable housing, will prioritize projects in communities with fewer or less expensive requirements. Many of the cities and towns that have already stepped forward to join the pilot program are fairly wealthy and may not be as concerned with the affect of a fossil fuel ban on the costs of housing development.

Yet, there may still be reason for optimism. As an example of what may be possible in a future that includes municipal fossil fuel bans, the Town of Brookline recently approved an affordable housing project that will be powered exclusively by electricity. In addition, Boston Mayor Michelle Wu recently signed an executive order that bans fossil fuel use in new city-owned buildings and in major renovations of municipal buildings. Even without municipal fossil fuel bans in place, some developers, including affordable housing developers, in Massachusetts communities are choosing to build fossil fuel-free.

Yet, there may still be reason for optimism. As an example of what may be possible in a future that includes municipal fossil fuel bans, the Town of Brookline recently approved an affordable housing project that will be powered exclusively by electricity. In addition, Boston Mayor Michelle Wu recently signed an executive order that bans fossil fuel use in new city-owned buildings and in major renovations of municipal buildings. Even without municipal fossil fuel bans in place, some developers, including affordable housing developers, in Massachusetts communities are choosing to build fossil fuel-free.

The future of fossil fuel-free building in Massachusetts is uncertain. The legislature may choose to take a more aggressive approach than it did during the last session, or it may wait to see how DOER’s implementation of the pilot program goes, leaving Massachusetts cities and towns and developers to continue to innovate on their own. States are often called “laboratories of democracy,” but when it comes to issues like climate change, where municipalities acting individually may be able to make a large impact, that label may better suit cities and towns as they try again and again to form creative solutions where their state legislatures fall short.

Hayley Kallfelz graduated with a juris doctor from Boston University School of Law in May 2023.

Hayley Kallfelz graduated with a juris doctor from Boston University School of Law in May 2023.

End the Request: It’s Time for Boston’s Biggest Landowners to Pay Their Fair Share

For the second time, Massachusetts State Representative Erika Uyterhoeven (D-Somerville) filed a bill concerning payments in lieu of taxes to cities and towns. This bill would strengthen and codify a Boston program, which requests payment from certain institutions that do not pay property taxes. It is important that this bill passes during the 2023-24 session because, without it, Boston (and other municipalities) will continue to subsidize large, private organizations at the expense of its own residents.

The City of Boston’s budget

The City of Boston’s operating budget consists of revenue from property taxes, state aid, local revenue, and, to a small extent, non-recurring revenue (e.g., funds from the American Rescue Plan Act). This revenue is used to fund programs and services, including public education, public safety, city departments, and transportation. Property taxes are consistently the City’s largest source of revenue, and its share size continues to increase as state aid decreases. For example, 74% of the City’s revenue is derived from property taxes this year compared to 52% in 2002.

Boston residential taxpayers currently pay $10.74 per $1,000 value in property taxes. This number is higher than its surrounding municipalities: Cambridge taxpayers spend $5.86; Somerville taxpayers spend $10.34 and Medford taxpayers spend $8.65. Boston commercial taxpayers, including small businesses pay $24.68 per $1,000 value in property taxes. This number is also higher than its surrounding municipalities: Cambridge commercial tax payers spend $11.23, Somerville commercial taxpayers spend $17.35, and Medford commercial taxpayers spend $16.56.

Part of the reason why Boston’s property taxes are so high is that Boston’s tax base is constrained. Boston’s geographic region is relatively small and is home to many tax-exempt institutions.

52% of Boston’s area is tax exempt.

Tax-exempt areas include public land owned by the city, state, and federal government along with private land owned by universities, hospitals, and cultural institutions. These institutions are not required to pay property taxes as nonprofit charitable organizations under section 501(c)(3) of the Internal Revenue Code. In Boston, this includes large, private institutions––like Mass General Brigham, Harvard, Boston University, and Northeastern––that together own over $14 billion of Boston’s real estate.

These large institutions do make some financial contributions to the city of Boston via the Payment in Lieu of Tax (“PILOT”) program. The PILOT program asks educational, medical, and cultural institutions with more than $15 million worth of tax-exempt property to make voluntary payments to the City of Boston. These contributions are supposed to be 25% of the would-be property taxes, and up to 50% of this payment can be in the form of “community benefits.” The 25% represents a “fair share” because large institutions’ use of essential services, such as fire safety, roads, public transportation, and sewage disposal generally make up 25% of a municipality’s budget.

The PILOT task force defines Community benefits “as services that directly benefit City of Boston residents; support the City’s mission and priorities with the idea in mind that the City would support such an initiative in its budget if the institution did not provide it; emphasize ways in which the City and the institution can collaborate to address shared goals; and, are quantifiable.” For example, these services can take the form of individual scholarships and job training initiatives. Other examples include summer camp and after school activities, preventative medical care, and maintenance of public spaces.

PILOT does not go far enough

Institutions often do not fulfill their PILOT requests from the City of Boston. During the 2022 fiscal year, Northeastern met 67% of its PILOT request. Boston University and Harvard did better, meeting 80% and 79% of their PILOT requests, respectively. However, these institutions tend to max out their community benefits. For example, during the 2022 fiscal year, the City of Boston requested $66,709,087 from educational institutions and received $30,793,921 in community benefits and only $14,788,450 in cash contributions. Here, it is worth emphasizing that $66,709,087 is only one quarter of what these institutions would pay if their properties were not tax-exempt.

Ever more, these private institutions look increasingly less like tax-exempt charitable organizations. Many of the institutions have large budgets. For example, Harvard has its own Management Company overseeing the investing of its $53 billion endowment. Harvard Management Company is registered as a 501(c)(3) non-profit and does not pay property taxes in Boston.

Ever more, these private institutions look increasingly less like tax-exempt charitable organizations. Many of the institutions have large budgets. For example, Harvard has its own Management Company overseeing the investing of its $53 billion endowment. Harvard Management Company is registered as a 501(c)(3) non-profit and does not pay property taxes in Boston.

Boston should be able to increase the amount of money generated from the city’s PILOT program to alleviate the pressure on its residents and small business owners and to ensure that large institutions pay their fair share for essential services. Changing these institutions from 501(c)(3) status to require payment of property taxes is likely a political and bureaucratic nightmare, especially given these institutions’ reliance on the nonprofit status. That said, some Massachusetts legislators are taking steps to ensure that universities, hospitals, and cultural institutions start to pay their fair share.

Bill H.2963

Representative Erika Uyterhoeven refiled Bill H.2963, An Act Relative to Payments In Lieu of Taxation by Organizations Exempt from the Property Tax on January 19 this year. The proposed bill:

- allows cities or towns to charge 501(c)(3) organizations 25% of their would-be property taxes, so long as the exempt organization owns at least $15 million worth of property;

- requires these cities or towns to adopt an ordinance or bylaw to describing the agreement between the municipality and the tax-exempt organizations; and

- allows these local ordinances and bylaws to have exemptions from payment and considerations of community benefits in lieu of cash contributions.

Importantly, this is a local option bill, which means that municipalities are allowed to require large, non-profit institutions to pay 25% of their would-be property taxes but do not have to. The language of this bill largely tracks Boston’s PILOT program but mandates (rather than requests) the payment of 25% of a large institution’s would-be taxes. It is not clear whether this mandate runs afoul of the Massachusetts Constitution, which requires properties in the same property class (e.g., residential, commercial, industrial) to be taxed at the same rate. It is possible that the bill is meant to be a “fee” rather than a tax, in which case the funds should only be used for essential services.

During the 2021-22 session, Representative Uyterhoeven testified at the previous bill’s public hearing. She emphasized that the bill is for very large institutions and “not for churches, not for small kitchens, or anything like that, it’s really just for the large nonprofits, the health care facilities, universities. This comes from an equity issue around large nonprofits needing to pay their faire share to all of the things that municipal budgets serve them.” That said, the bill does not contemplate an exemption for churches, and it is possible that at least some churches have $15 worth of land and cannot afford the 25% of their would-be property taxes. It would be up to municipalities to include exemptions for specific organizations within their bylaws and ordinances, which may be politically difficult.

The City of Boston should opt-in

Bill H.2963 is currently with the Committee on Revenue. It is not clear that this bill has traction or will pass into law––the legislature has considered similar bills as early as 2013 and the bill was sent for study last session, often a quiet way to kill a bill.

However, if the bill does pass, Mayor Wu and her team should push to adopt an ordinance or bylaw given the City of Boston’s reliance on property taxes. Boston lawmakers should be conscious of their exemptions. One worry is that residents may make value judgments and target organizations that they do not like through a mandated fee.

Boston lawmakers should consider lowering the percentage of community benefits the City of Boston will accept. Although there is great value in community benefits, in practice they benefit individual residents rather than fund the City’s operating budget.

The Massachusetts legislature has an opportunity to fix a loophole in property taxes that allows large, private institutions to take advantage of their 501(c)(3) status to avoid paying property taxes. Bill H.2963 is a step in ensuring that these institutions start to pay their fair share and is a model for other states and municipalities dealing with similar challenges. If the bill becomes law, the City of Boston urgently needs to adopt an ordinance or bylaw to relieve economic pressure on residents and businesses, who currently fund the majority of the City’s operating budget.

Alison Kimball anticipates graduating with a juris doctor from Boston University School of Law in May 2024.

Alison Kimball anticipates graduating with a juris doctor from Boston University School of Law in May 2024.

Congestion Pricing: Addressing The True Cost of Cars

One of the most heartening social trends of the last couple of years has been a recognition of the true costs of car use in cities. Whether approaching it from the stance of climate change, health effects from air quality, physical safety on the roads, or social fragmentation from structures that isolate and alienate people, it has become increasingly clear that we do not properly value our roads. One policy with great potential to address all these concerns, while generating considerable revenue that could support mass transit in cities, is congestion pricing of key roads in urban centers.

The idea behind congestion pricing is that roadways are incredibly valuable real estate, which people do not pay to use (outside of some tolling on bridges and specific toll roads). The free use of the roads imposes significant social costs on the city's inhabitants through bumper-to-bumper traffic, costing people time, and polluting the air. A congestion pricing system would impose a toll on entrants to designated zones. This would reduce traffic by imposing the true costs of using the road, and hopefully, diverting people to use mass transit or other forms of transportation. The beneficial effects would range from clearing congestion, to reducing air pollution, to generating significant revenue for the city.

The idea behind congestion pricing is that roadways are incredibly valuable real estate, which people do not pay to use (outside of some tolling on bridges and specific toll roads). The free use of the roads imposes significant social costs on the city's inhabitants through bumper-to-bumper traffic, costing people time, and polluting the air. A congestion pricing system would impose a toll on entrants to designated zones. This would reduce traffic by imposing the true costs of using the road, and hopefully, diverting people to use mass transit or other forms of transportation. The beneficial effects would range from clearing congestion, to reducing air pollution, to generating significant revenue for the city.

This is no longer merely a thought experiment either. Notably, cities including London, Stockholm, and Singapore, have all implemented congestion pricing in their city centers to great positive effect. They generally see reduced car congestion, but also interestingly, greater total numbers of people accessing the city, as they come in via alternate methods. This increases economic value to the city without imposing any of the normal car related costs.

No American city has successfully implemented this policy yet, but New York is currently in the middle of a now 5 year long battle to try. In 2019, the New York State legislature passed, in the state budget, a law permitting the city of New York to implement a congestion pricing plan. Curiously, New York City does not control its own road system, and is therefore dependent on the state to give permission to implement such a project. This is relatively common in the U.S. and is in tension with the age-old principle of local control. It also raises a potential problem where a star city in a state drives a significant portion of that state’s revenue, but has strong political disagreements with the state government. In New York the success of the plan at the state level was over 50 years in the making. New York State had frequently prevented the city from implementing similar congestion pricing programs in the past, when the city had tried to reduce traffic.

Despite state approval, congestion pricing in New York has been stuck in limbo, in part due to federal law. Title 23 of the Federal Code prohibits municipalities from imposing tolls on roads constructed or maintained with federal funding, which include several New York City roads. To impose tolls, New York had to enlist in the Federal Highway Administration's Value Pricing Pilot Program (VPPP), which gives up to 15 cities or states special permission to experiment with toll related projects on federally funded roads. Congestion pricing plan falls under the purview of the National Environmental Protection Act (NEPA) because it is enrolled in the VPPP.

Passed in 1970, NEPA mandates environmental review of federal projects. While proponents argue that NEPA is an essential defense for the environment from human exploitation (both for its own sake and also to protect our habitat), critics traditionally argue it prevents profitable projects. Now environmentally minded advocates are increasingly frustrated with NEPA’s requirements. They argue NEPA’s onerous procedural requirements, which often require millions of dollars and years of effort, are inhibiting projects that would benefit the environment, violating its fundamental purpose.

It is clearly the case in New York right now that the city is suffering from these unnecessary delays. It took 2 full years just for the federal government to determine whether the appropriate environmental review was a relatively basic Environmental Assessment, or a complete Environmental Impact Assessment for the project and another 2 years to issue the determination report. Now, going on 5 years from initial passage, the city is still waiting for a final determination if the project is viable. All of this for a project that requires the city to build almost no physical infrastructure, and would dramatically reduce emissions and air pollution by reducing the number of cars driving in New York.

It is clearly the case in New York right now that the city is suffering from these unnecessary delays. It took 2 full years just for the federal government to determine whether the appropriate environmental review was a relatively basic Environmental Assessment, or a complete Environmental Impact Assessment for the project and another 2 years to issue the determination report. Now, going on 5 years from initial passage, the city is still waiting for a final determination if the project is viable. All of this for a project that requires the city to build almost no physical infrastructure, and would dramatically reduce emissions and air pollution by reducing the number of cars driving in New York.

The FHWA can remedy this issue by assigning congestion pricing projects a Categorical Exclusion (CE). A CE is used for projects that are known not to have negative environmental impacts. It exempts them from the entire Environmental Impact Statement and Environmental Assessment process. It is commonly used in projects where there will not be significant physical infrastructure created, much like the congest program. The programs would still have to present reasons why they should be granted the exclusion, so this will not totally eliminate any environmental review, but it will bring the level of review in line with the risks that the project actually presents.

New York’s experience shows the complex thicket of legislation and regulation that creative environmentalists must navigate in order to successfully pursue valuable projects. Congestion pricing is a perfect example because it is so cheap to implement, the primary difficulty should be political, in getting state legislatures to pass laws giving permission for cities to enact it. More American cities including San Francisco, Los Angeles, and Seattle have shown interest but have shown extreme caution in part because they know how difficult the implementation will be. Instead of trusting legislators and representatives to work on behalf of city residents, needlessly complex and blunt regulations are stepping in the way and forcing us to continue to choke cities in idling car fumes.

Peter Kaplan anticipates graduating from Boston University School of Law in May 2024.

Peter Kaplan anticipates graduating from Boston University School of Law in May 2024.

Accelerated Public Health Modernization in Massachusetts

Amid the ongoing COVID-19 pandemic and national movements for public health modernization, the Massachusetts Legislature tried to strengthen the Commonwealth’s public health during the summer of 2022. The Statewide Accelerated Public Health for Every Community Act (H.5014) (SAPHE 2.0) would have required local boards of health and regional health districts to comply with new minimum standards for public health service delivery. Governor Baker, however, proposed making the standards optional for municipalities, effectively killing the bill for the 2021-2022 legislative session. Fortunately, a new governor and legislature may provide some hope for this bill.

Public Health Modernization in Massachusetts

SAPHE 2.0 is a continuation of recent efforts by the Massachusetts Legislature to strengthen public health systems in the Commonwealth. In 2016, Governor Baker signed a legislative resolve establishing a special commission to “assess the effectiveness and efficiency of municipal and regional public health systems and to make recommendations regarding how to strengthen the delivery of public health services and preventive measures.” In 2019, the Special Commission on Local and Regional Public Health published a final report that found many local boards of health struggle to comply with public health service delivery statutes and regulations. More troubling, municipal compliance fell below national expectations set by frameworks like the Center for Disease Control and Prevention’s 10 Essential Public Health Services, and the Public Health Accreditation Board's Foundational Public Health Services that defines the minimum set of services and capabilities each health department required for its voluntary national public health accreditation program. The Special Commission noted that Massachusetts has 351 local boards of health–the largest number within any state, due in part to the Commonwealth’s emphasis on local autonomy–rather than the boards organized by county in other states. As a result, Massachusetts boards lack the capacity to deliver necessary public health services compared to larger health departments in other states, which have greater resources. The Special Commission recommended establishing minimum standards for public health in Massachusetts, which could help local boards of health achieve compliance with state requirements and then work toward accreditation, and facilitating cross-jurisdictional service sharing arrangements, among other reforms.

In April 2020, Governor Baker signed An Act Relative to Strengthening the Local and Regional Public Health System into law. The Act established the “State Action for Public Health Excellence” (SAPHE) program that aimed to “improve the efficiency and effectiveness of the delivery of local public health services” in the Commonwealth through funding and technical assistance related to cross-jurisdictional collaboration, data sharing, workforce development, and other domains. The Act also charged DPH with defining minimum standards for foundational public health services in Massachusetts to enhance governmental public health performance. This legislation, however, made these standards voluntary and aspirational. The Act incentivized participation through a grant program to fund municipalities involved in planning, capacity building, and implementation of cross-jurisdictional sharing arrangements. The Department of Public Health currently funds 41 grantees representing 76% of municipalities across the state.

SAPHE 2.0

The Statewide Accelerated Public Health for Every Community Act, dubbed “SAPHE 2.0,” builds upon the 2020 law to continue strengthening public health systems in the Commonwealth. Critically, the bill would require municipalities to meet DPH’s minimum public health standards and provide material support to municipalities. SAPHE 2.0 would have also augmented the existing grant program in two ways: expanding the availability of competitive grants (establishment of shared service arrangements and expansion of existing arrangements) and providing grants and technical assistance to help health departments with “limited operation capacity” to meet requirements. The House and Senate unanimously passed the bill on July 29, 2022.

The Statewide Accelerated Public Health for Every Community Act, dubbed “SAPHE 2.0,” builds upon the 2020 law to continue strengthening public health systems in the Commonwealth. Critically, the bill would require municipalities to meet DPH’s minimum public health standards and provide material support to municipalities. SAPHE 2.0 would have also augmented the existing grant program in two ways: expanding the availability of competitive grants (establishment of shared service arrangements and expansion of existing arrangements) and providing grants and technical assistance to help health departments with “limited operation capacity” to meet requirements. The House and Senate unanimously passed the bill on July 29, 2022.

Proponents of SAPHE 2.0 support standardization of public health performance to ensure all Massachusetts residents receive comprehensive, high-quality public health services. A coalition led by the Massachusetts Public Health Association (MPHA) advocated for the bill, emphasizing that the decentralized approach to public health service delivery in the Commonwealth “leads to extreme variability across municipalities.” The MPHA also noted that the COVID-19 pandemic has exacerbated underlying public health inequities and called on the Legislature to “invest in creating a stronger, more equitable system that will provide essential public health protections to all residents.”

Executive Disapproval

In August 2022, Governor Charlie Baker declined to sign the bill and returned it to the Legislature with significant proposed amendments. Governor Baker supported the bill’s objective to “provide high-quality, coordinated and more uniform public health services across the Commonwealth” but expressed concern about the lack of guaranteed state funding to complement performance requirements for municipalities, which creates the potential for unfunded mandates. He also expressed concern that the bill lacked provisions requiring municipalities to maintain their own current levels of public health funding as a condition of receiving support from DPH. Accordingly, Governor Baker proposed to not mandate that local boards of health meet minimum public health standards, but instead permit them to opt in to receive funding from DPH to meet those standards while requiring them to maintain their existing municipal funding levels for public health services.

The MPHA criticized the proposed amendments, indicating they would “entrench the patchwork of municipal policies that makes our local public health system both ineffective and inequitable” (email newsletter on September 27, 2022). However, Governor Baker’s rejection of the bill reflects the primary motivations against it: the potential for local boards of health to receive no state funding to support their compliance with minimum standards. The Massachusetts Municipal Association (MMA) echoed Governor Baker’s sentiments, indicating support for “the intent of the legislation” but noting “strong concerns that the measure as written could impose a new annual unfunded mandate on municipalities.” Delivering testimony on the proposed bill, the MMA noted that “as written, H. 5104 does not mandate that the state meet its obligation to financially support the outlined goals. Instead, the state’s responsibilities would be subject to appropriation, while municipalities would not have that flexibility, and would be forced to fund the new costs imposed by the Department of Public Health.”

The Path Forward

SAPHE 2.0 is a microcosm of perennial public health concerns: how to deliver high-quality services and ensure equitable distributions of health burdens and benefits with limited resources. Governmental public health’s experiences during the COVID-19 pandemic laid bare structural health inequalities and emphasized the need for effective public health services and infrastructure, but also revealed logistical challenges inherent in forcing decentralized entities to act in tandem.

Although SAPHE 2.0 has been defeated in the short term, its longer-term prospects look promising: Governor Maura Healy took office in January 2023, and the Joint Committee on Public Health is considering a newly refiled version of the proposal. Public health advocates will continue to champion modernization efforts to advance the optimal health of all communities in Massachusetts.

Shannon Gonick anticipates receiving her juris doctor from Boston University School of Law in May 2024.

Shannon Gonick anticipates receiving her juris doctor from Boston University School of Law in May 2024.

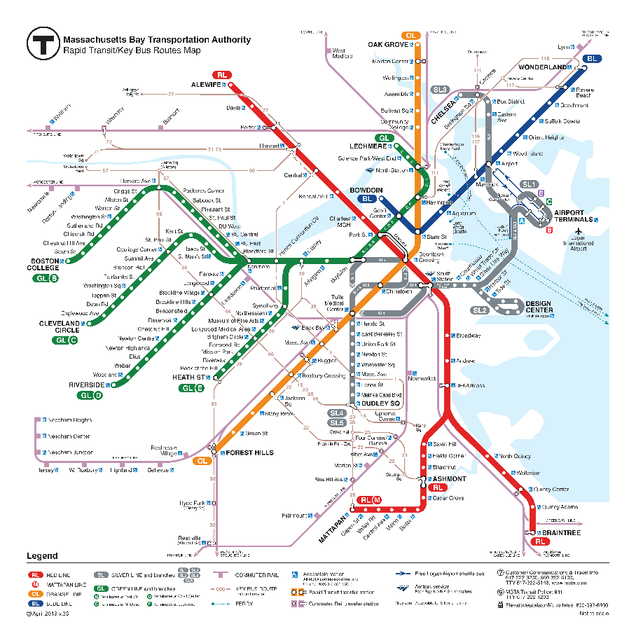

Boston T Party: Using Transatlantic Policymaking to Push Free Public Transit in Massachusetts

If you've lived anywhere near the Boston metropolitan area in the past few months, you will no doubt have faced a barrage of discussion in the media and manifestos about the prospects of making the T (Boston's public transport system) free for all riders. Mayor Michelle Wu has headed up the push to make the historic MBTA free and used it as a major issue in her Mayoral campaign. Mayor Wu wrote an Op-Ed in the Boston Globe as far back as January 2019 advocating for free public transit, citing improvements to air quality, economic mobility, racial equity. Wu even donned a golden, token style pendant with the classic T logo in many of her campaign advertisements. This in-vogue concept also has the support Congresswoman Ayanna Pressley and former Democratic candidate for governor and former state senator Ben Downing vowed to "make the T free by the end of his first term." Another former gubernatorial candidate state senator Sonia Chang-Diaz proposed a state-wide free public transportation agenda, starting with buses. There have been small steps toward this goal such as making three bus lines free for two years. This article is designed not to demonstrate the positives of free public transit, of which I am a strong proponent, but how we can make the program more palatable for those on Beacon Hill.

But there are sceptics and critics at all levels of Massachusetts politics. Former Mayoral candidate Annissa Essaibi George would criticize the idea of going entirely “fare-free” as fanciful, while House Speaker Ron Mariano and Senate President Karen Spilka have not committed to a fare-free MBTA system. Importantly, current Massachusetts Governor Charlie Baker opposed the idea of eliminating fares, unless “Boston is willing to pay.” Baker does raise some compelling points, asking why those in “the Cape, on the North Shore, in Central or Western Mass” should pay for Boston riders. Currently, fares account for only around a third of the MBTA’s $2 billion budget, so how do you make up this shortfall in the utopia of a fare-free city?

This is a bold, progressive, and commendable policy proposition, and while it may be very popular amongst locals, there is not much appetite for it on Beacon Hill due to cost. Most proponents suggest funding this program by raising taxes. Ben Downing proposed using some of the $5 billion in funds from the American Rescue Plan Act, and tax revenue from a popular “millionaires’ tax,” as well as gas tax hikes of 10-15 cents (bearing in mind this was proposed pre-inflation and the Ukraine/Russia conflict) and a sales tax on Uber and Lyft rides. Sonia Chang-Diaz likewise has proposed levying a state millionaires’ tax to fund the policy. Michelle Wu took a slightly different approach, suggesting that “regional ballot initiatives” are the way to raise finances for a free MBTA. Regional ballot initiatives ask voters in localities in a small demographic if they approve of raising certain taxes i.e., sales, emissions, property tax. This is certainly one way to rebut Governor Baker's “why should Massachusetts pay for Boston” argument.

Temporary funding like the ARPA is not sustainable and increased gas taxes is probably a non-starter in this age of sky high gas prices, although Sen. Downing was right to use the problem to pay for the solution. A millionaires’ tax may be a popular possibility, but may not be long-standing enough or raise enough to subsidize the T. Wu’s regional ballot initiative idea is more compelling and something we see elsewhere, (California, Colorado, Georgia etc.), but asking local riders to pay for something they want to make free seems counterintuitive.

There is room, however, for creative policymaking solutions to kill two (or three) birds with one stone. Owing to my transatlantic tendencies, I believe the city of Boston should implement a “Ultra-Low Emissions Zone” used by the city of London. The ULEZ is a mapped zone in the London city centre that, once entered, registers your license plate with cameras, and charges you £12.50 for vehicles not compliant with emissions standards. In the first year, the ULEZ brought in £400 million in revenue, equivalent to around $524 million USD. Of course, congestion charges are not free of controversy, and special considerations or permits must be given to taxis, Ubers, first responders and construction companies working in the city for a prolonged period. London is, however, significantly larger than Boston, and does not use the funds to subsidise the public transportation system. This can be done on a smaller scale within the city limits of Boston, perhaps inclusive of the area spanning the green line.

There is room, however, for creative policymaking solutions to kill two (or three) birds with one stone. Owing to my transatlantic tendencies, I believe the city of Boston should implement a “Ultra-Low Emissions Zone” used by the city of London. The ULEZ is a mapped zone in the London city centre that, once entered, registers your license plate with cameras, and charges you £12.50 for vehicles not compliant with emissions standards. In the first year, the ULEZ brought in £400 million in revenue, equivalent to around $524 million USD. Of course, congestion charges are not free of controversy, and special considerations or permits must be given to taxis, Ubers, first responders and construction companies working in the city for a prolonged period. London is, however, significantly larger than Boston, and does not use the funds to subsidise the public transportation system. This can be done on a smaller scale within the city limits of Boston, perhaps inclusive of the area spanning the green line.

What this ULEZ would do in Boston is not only grant the accessibility, economic mobility, job creation and ridership but also substantially reduce the emissions of vehicles which count towards 40% of the carbon footprint of Massachusetts. This way, you can tax the problem as well as make those who want to come to Boston pay for Boston public transit. Alongside this, the need for road maintenance, a major gripe of New Englanders, would be significantly reduced on the city’s busiest roads – a significant cost to the public purse.

An exponential increase in ridership post COVID-19, is what the T needs, and as shown by making the Route 28 bus free in a pilot scheme, ridership increases by at least 22%, something that would undoubtedly be higher in high traffic lines like the green line. Higher ridership alone can help with budgetary issues. Being able to have thousands more take the city subway into pandemic-recovering businesses and restaurants would be a welcome injection of footfall. This would be both a sustainable, and environmentally sustainable policy concept that could continually fund the shortfall that a free transit system would create in the budget.

As outlined by Attorney General and gubernatorial candidate Maura Healey, there is a growing consensus that Massachusetts infrastructure is crumbling, and drastic investment is an absolute requirement. Massachusetts is in a rare position where we can slash deadly emissions caused by vehicle pollution whilst simultaneously. The 15% of annual income that everyday Americans fork out for transportation, would be greatly reduced in metropolitan Boston. ‘But there is also momentum in the notion that environmental justice equals racial justice, and a huge step towards achieving transit justice would be taken by implementing the ULEZ to fund the hallmark of Massachusetts’ public transit system. That is how you make Boston a pioneer in sustainability, and an easy pill for Beacon Hill to swallow in one fell swoop.

Jack Ford McDonald Morton graduated from Boston University School of Law with an LLM in American Law in May 2022. He graduated from the University of Strathclyde in 2020 with an honors LLB degree in Scots and English Law. He was named a Saint Andrews Society of the State of New York scholar to attend BU Law.

Jack Ford McDonald Morton graduated from Boston University School of Law with an LLM in American Law in May 2022. He graduated from the University of Strathclyde in 2020 with an honors LLB degree in Scots and English Law. He was named a Saint Andrews Society of the State of New York scholar to attend BU Law.

Checks & Balances in a Pandemic

Recently, Shelley Luther, a Dallas based hair salon owner was jailed for refusing to close down her salon. The owner of Salon à la Mode continued operating her business despite a temporary restraining order last week from Dallas County State District Judge Eric Moyé. She continued operating despite a county official’s cease-and-desist letter ordering her to close.

As Luther faced criminal and civil contempt-of-court charges, Judge Moyé told Luther to admit her actions were selfish and wrong and promise that she would follow the law. CBS DFW reported that Luther refused responding,

“I have to disagree with you, sir, when you say that I’m selfish, because feeding my kids is not selfish. I have hair stylists that are going hungry because they’d rather feed their kids. So, sir, if you think the law is more important than kids getting fed, then please go ahead with your decision, but I am not going to shut down the salon.”

This answer did not please Judge Moyé, who immediately sentenced Luther to seven days in jail. Luther was not given an opportunity to go home or even have a phone call, if it hadn’t had been for her boyfriend her adolescent daughter would not have understood why her mother didn’t come home that night.

During the COVID-19 Coronavirus Pandemic, officials have agreed that jail is a breeding ground for the virus. In order to best protect the people, officials have quickly worked to release many non-violent prisoners for the sake of their health. Dallas county specifically released 1,000 inmates to ease crowding in the hopes to slow the spread of COVID-19 at the Dallas County jail. At a time where officials are releasing prisoners, I find it inappropriate to make an example of Luther by throwing her in jail. Not only was this action a risk to her health, but a risk to her family and those exposed to her when she would be released a week later. Additionally, if Luther had been asymptomatic there was a risk that she herself could have brought the virus into the prison.

Furthermore, Dallas County District Attorney John Creuzot announced policy reforms plans to end mass incarceration in Dallas by decreasing the use of excessively high bail amounts, no longer prosecuting most first-time marijuana offenses and not prosecuting thefts of personal items under $750 that are stolen out of necessity. These policy reforms were established to decrease the number of incoming prisoners. Again, at a time where officials are fighting to decrease prison populations, Moyé’s actions neglected to consider the bigger picture. A better alternative would have been a fine for each day she was in operation, with the money allocated to benefiting the community.

Due to public outcry, Gov. Greg Abbott modified his executive orders to remove confinement as a consequence for violating them. He stated:

“Throwing Texans in jail who have had their businesses shut down through no fault of their own is nonsensical, and I will not allow it to happen,” Abbott said in a statement Thursday. “That is why I am modifying my executive orders to ensure confinement is not a punishment for violating an order.”

His change supersedes local orders and Luther was subsequently released. Luther was fined $7,000 for violating a temporary restraining order against reopening her business. However, Lt. Gov. Dan Patrick pledged to step up and pay the fine on her behalf.

The COVID-19 Coronavirus is an unprecedented time in our nation’s history, with legislators unsure how to best regulate protective measures. State legislators have gained an enormous power with COVID-19 Coronavirus. Without a doubt aggressive government intervention has occurred during this health crisis. Historically, pandemics have led to an expansion of the power of the state. Looking towards the future, legislators will have to work to strike a balance between protective regulations and domineering policies.

Diana Alexandra Martinez anticipates graduating from Boston University School of Law in May 2021.

Diana Alexandra Martinez anticipates graduating from Boston University School of Law in May 2021.

Funding the MBTA: Getting Derailed Plans Back on Track

Taking the T

The transit system of Eastern Massachusetts, governed by the Massachusetts Bay Transportation Authority, has been the subject of much ire by residents of Greater Boston for decades, particularly where the subway, or “T,” is concerned. A prime example is last year’s decision to raise fares by 6% despite continual failures in service, such as a recent derailment on the Red Line and power shutdown on the Blue Line. As the oldest subway system in North America, many of the T’s problems stem from decades- or even century-old design decisions which are impractical to redo today. For example, its hub-and-spoke layout emphasizes access to downtown Boston at the expense of ease of travel between the edges of the system.

Broke, But Not Broken

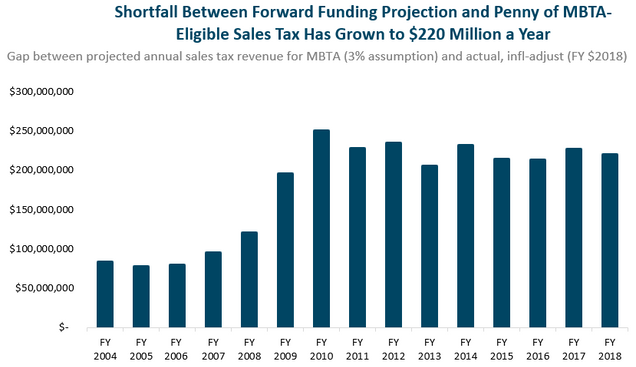

However, the primary barrier to the T being the efficient, functional transit system that Boston needs it to be is insufficient funding relative to necessary maintenance and upgrades, not to mention its current debt load. Though the MBTA system as a whole sees more than $2 billion in annual revenue, it still endures annual operating losses of more than $36 million. Significantly, the majority of its revenue does not come from operations, i.e. fares collected, but rather from sales tax and local assessment contributions. For nearly twenty years, a “penny” of all non-meal-and-drink sales tax revenue in Massachusetts has been dedicated to the MBTA budget. Because this source of tax revenue has not grown as anticipated, the MBTA budget has consequentially fallen short of expectations by well over $200 million per year. Meanwhile, costs of new projects continue to balloon. The cost of an upgraded fare collection system, originally budgeted at just over $700 million, has now grown to over $900 million.

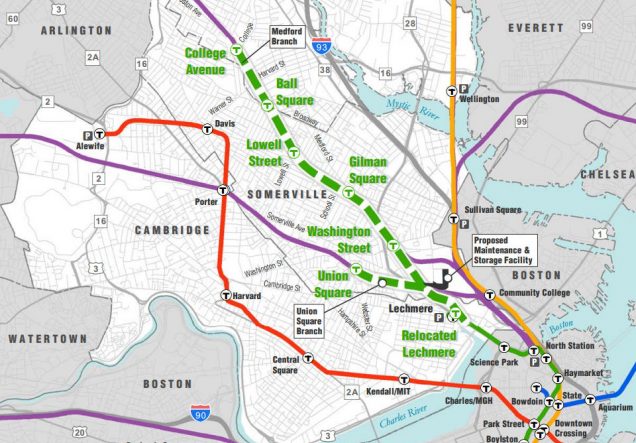

Boston City Councilor Michelle Wu argues that incremental fixes and patching of problems is insufficient; rather, we must invest in the system as a whole with a focus on expanding access. The necessity of serious capital investment became especially apparent after historic blizzards in early 2015 forced a system-wide shutdown. Wu has pointed to Governor Charlie Baker’s reluctance to act as an obstacle to the requisite overhaul the T needs. In response to pressure from her and other transit advocates, last summer Gov. Baker announced plans to accelerate an ongoing five-year, $8 billion capital investment program which kicked off in early 2019. The program aims to provide new rapid-transit buses and train cars, modernize the Red and Orange Lines, and fund a major expansion of the Green Line into underserved areas of Somerville and Medford. The latter, a long-suffering project decades in the making, is an example of the importance of major investment in transit: once complete, the percentage of Somerville residents within walking distance to light rail will increase to 80%, up from a current 20%. Gov. Baker’s acceleration includes more aggressive closures to allow for infrastructure work, more inspections and maintenance, negotiations with contractors, and the creation of a new team of MBTA personnel with the flexibility to work on multiple projects.

Capital Infusions

Even so, continued problems, such as the aforementioned Red Line derailment, prompted Gov. Baker to propose an $18 billion bond bill for transportation throughout the Commonwealth last year, providing money to the entire Massachusetts Department of Transportation, including a $5.7 billion slice for the MBTA. This bill, An Act Authorizing and Accelerating Transportation Investment, most recently received approval, with an amendment, from the House Committee on Bonding, Capital Expenditures and State Assets and moved before the House Committee on Ways and Means in late February, 2020. This Act would fund road and bridge repairs, MBTA upgrades, and the electrification of regional transit services, as well as contribute to big projects such as Cape Cod Canal bridges and the Green Line Extension. The bill also provides support for improving pavement on public roads and building small bridges as well as help for municipalities seeking to make their roads more cyclist- and pedestrian-friendly. Other provisions aim to reduce traffic congestion and greenhouse gas emissions by building bus lanes and working to reduce bottlenecks. Transportation Secretary Stephanie Pollack highlighted the importance of action on other projects which complement improved transit service to maximize the impact of the bill. Such legislation includes Gov. Baker’s proposed Housing Choices Act, which would streamline zoning approval for certain housing projects.

This past January, Gov. Baker also proposed a $135 million budget increase for the MBTA, possibly in response to a scathing December 2019 report by the Safety Review Panel which found deficiencies “in almost every area” of the MBTA system. A major criticism was the recent over-emphasis on capital improvements and not enough support for regular maintenance and safety, with staff being diverted away from the latter. However, it is unclear how exactly the infusion of funding would be spent.

It should be noted that there currently remain $743 million in outstanding senior revenue bond loans to MassDOT, though the Department maintains an A+ rating for borrowing. Though the Act Authorizing and Accelerating Transportation Investment would be funded by further borrowing via bonds, its original version allocated half of all revenue from a potential greenhouse gas cap-and-trade program with other states in the region to public transit, creating a stream of revenue as well as encouraging more fuel-efficient cars. However, that provision was stricken by the Transportation Committee, which argued that they cannot allocate funds to a program that does not yet exist. Lawmakers instead plan to increase fees on transportation network companies and deeds excise taxes.

COVID-19 Crisis

The amendments, including those made earlier by the House Committee on Transportation, include the elimination of $50 million in business tax cuts to encourage employees to work from home and thus reduce traffic congestion, a quaint decision in the midst of the COVID-19 pandemic which has forced millions to work from home anyway. The MBTA has been understandably hit hard, and as of April, ridership on the T was down more than 90% from late February, with bus service down nearly 80%. Anticipated losses this year exceed $213 million due to a 95% plunge in fare collection and drops in revenue from advertising and state sales tax. MassDOT hopes to cover the loss with an expected infusion of $840 million in federal funds through the CARES Act. Meanwhile, the MBTA has reduced service, instituted cleaning and sanitizing regimes for vehicles, and has begun requiring employees and remaining riders to wear face masks.

Needless to say, major investment decisions as of this writing have been put on hold. However, once this crisis has passed, it is critical that Massachusetts act to ensure its transit services remain a functional asset to the people of the Greater Boston Area and beyond.

Kellen Safreed anticipates graduating from Boston University School of Law in May 2021.

Kellen Safreed anticipates graduating from Boston University School of Law in May 2021.

To Combat Adolescent Tobacco Use, Federal Law Raises Purchasing Age to 21

In the final weeks of 2019, in the wake of an outbreak of vaping-related illnesses and death, the federal government raised the minimum age of tobacco sales from 18 to 21. The widely-supported amendment to the Food, Drug, and Cosmetic Act was included in an appropriations bill that Congress approved on December 19th and President Trump signed into law the next day. The new law makes it illegal to sell tobacco products, including electronic cigarettes/vapes, to anyone under the age of 21 throughout the United States. While the law is a positive step for public health, it is long overdue and lacks much needed enforcement enhancement measures.

The federal government followed in the footsteps of 19 states, Washington D.C., and hundreds of local governments which had already increased the tobacco age to 21. The push to increase the tobacco age is referred to as the Tobacco 21 movement. The first Tobacco 21 law was enacted in Nedham, Massachusetts in 2005. In 2013, New York City became the first major city to pass a Tobacco 21 law. The wave of state-level Tobacco 21 laws began in 2016 with Hawaii and California, and continued with

Washington and New Jersey in 2017, Oregon, Maine and Massachusetts in 2018, Virginia, Illinois, Delaware, Arkansas, Maryland, Vermont, Texas, Connecticut and Ohio in 2019, and Washington, Utah, Pennsylvania, and South Dakota in 2020. New Mexico is the latest state to pass a tobacco 21 law which will go into effect in 2021.

The Tobacco 21 movement is supported by a strong foundation of research demonstrating the importance and efficacy of raising the age. In the Surgeon General’s 2012 report on Preventing Tobacco Use Among Youth and Young Adults, the epidemiological research showed that “adolescence and young adulthood represent[s] a time of heightened vulnerability to tobacco use and the initiation of cigarette smoking.” The rationale behind increasing the age from 18 to 21 is to reduce the number of people who begin smoking (or vaping) by making it more difficult to access tobacco during the years of highest vulnerability. And studies show that 98% percent of smokers begin before 26 years old and 90% of daily cigarette use begins before 20 years of age. Raising the age not only makes it more difficult for 18-20 year-olds to purchase tobacco, it also reduces access for minors who often rely on friends who are 18 and older to purchase tobacco products for them. In fact, it is estimated that “90% of persons who purchase cigarettes for distribution to minors are under 21.”

In addition to conventional cigarettes and tobacco products, Tobacco 21 laws also prevent people under the age of 21 from buying electronic cigarettes or vapes. This is because electronic cigarettes are deemed to be tobacco products by the FDA. Electronic cigarettes are the most commonly used tobacco products among youth today, and a 2018 study showed that 1 in 5 high school students and 1 in 20 middle school students use these products. Those numbers were likely even higher in 2019 when the mysterious vaping illnesses, which prompted this legislation, began. Even before the outbreak, the high rate of electronic cigarette use among American youth was troubling. Not only were public health officials warning of the known harms associated with vaping (such as potential for lung damage, and dangers of nicotine consumption for brain development), but also the universe of unknown risks associated with vaping as these products are relatively new and rapidly changing.

In addition to conventional cigarettes and tobacco products, Tobacco 21 laws also prevent people under the age of 21 from buying electronic cigarettes or vapes. This is because electronic cigarettes are deemed to be tobacco products by the FDA. Electronic cigarettes are the most commonly used tobacco products among youth today, and a 2018 study showed that 1 in 5 high school students and 1 in 20 middle school students use these products. Those numbers were likely even higher in 2019 when the mysterious vaping illnesses, which prompted this legislation, began. Even before the outbreak, the high rate of electronic cigarette use among American youth was troubling. Not only were public health officials warning of the known harms associated with vaping (such as potential for lung damage, and dangers of nicotine consumption for brain development), but also the universe of unknown risks associated with vaping as these products are relatively new and rapidly changing.

The vaping illness outbreak began in August 2019, when vaping product users— including many teens—suddenly began presenting to emergency departments with severe lung injuries. By December 4th, the Centers for Disease Control and prevention had confirmed over 2,200 cases and 48 deaths related to the outbreak. The reason for the sudden increase in vaping related illness was not immediately clear, and it stirred up panic among parents of teenagers and mobilized public health professionals who had long feared the harmful effects of vaping.