Personalized Handgun Law Backfires, by Merissa Pico

Like a gun might, this New Jersey legislature’s bill backfired. In 2002, New Jersey’s democratically controlled legislature passed the Childproof Handgun Law, which aimed to promote the use of personalized handguns.

Personalized guns, or “smart guns,” as they are also known, use technology so the guns can only be used by an authorized or recognized user.

The 2002 law, which was signed into law by then Governor James McGreevey, requires all handguns sold in New Jersey to be smart guns within 30 months of personalized handguns becoming available anywhere in the country. The statute tasks the New Jersey Attorney General with determining which handguns qualify as smart guns and when smart guns have become available as set forth under the law. In other words, it would not matter if a smart handgun was actually sold or not; as long as a smart handgun was available for sale anywhere in the nation, the clock would start and within 30 months, all handguns sold in New Jersey would have to be smart guns.

According to the 2002 law’s sponsor, New Jersey State Senate Majority Leader Loretta Weinberg (D-Bergen), the 2002 law’s objective was to stimulate the “research, development and manufacture” of smart guns.

Ironically, but perhaps not surprisingly, the law has had the opposite effect: it inadvertently stunted the availability of personalized handguns nationwide. Fifteen years since its enactment, smart handguns are still not available for purchase in the United States. This is despite the fact that the technology exists; smart guns are available for sale in Europe and Asia.

Viewing the New Jersey law as an attack on the second amendment, the pro-gun sector has stifled any movement in making smart guns available. In addition to one gun store in California, in 2014, one Maryland gun storeowner, Andy Raymond, set out to sell the first smart gun in the nation. However, like the California store, Raymond decided not to go through with making smart guns available for sale, after both received hundreds of protests on his store’s Facebook page as well as death threats. If Raymond or the California store had successfully done so, the thirty-month clock in New Jersey’s 2002 law would have started, an effect that the pro-gun sector was well aware.

While it is clear that the 2002 law effectively entrenched the standstill on smart gun development, it should be noted that the pro-gun lobby has not necessarily embraced the smart gun initiative with open arms over the years.

Opponents of the 2002 law have objected to the state-mandated market for smart guns, believing that a market for smart guns, if there should be one, should emerge without any government intervention. Further, many gun owners have concerns about the reliability of the smart gun technology, fearing that the technology will falter when and if they need it to protect their lives.

An attempt to fix this legislative conundrum that New Jersey’s legislature created for themselves and the rest of the country, the legislature in 2016 introduced a new bill, S816, to amend the 2002 law. Also sponsored by Senator Weinberg, S816 would repeal the portions of the 2002 law that would have made it illegal to sell traditional handguns once personalized hand guns become available, thereby effectively eliminating the technology freeze. Additionally, S816 mandates that firearms merchants and dealers maintain an inventory of at least one model of smart gun to sell. Under the bill, the Attorney General would determine on which smart guns would be acceptable.

The democratically controlled New Jersey senate approved the bill in February of 2016 by a vote of 21-13. New Jersey governor and former 2016 U.S. Presidential candidate, Chris Christie, pocket vetoed the bill in September of 2016. A pocket veto means that the governor does not return the bill to the New Jersey legislature; therefore, the veto cannot be overridden. In his strongly worded conditional veto message, Governor Christie said the new bill was the latest in the “relentless campaign by the Democratic legislature to make New Jersey as inhospitable as possible to lawful gun ownership and sales.” Believing that the new bill’s mandate is a constraint on business and “likely is unconstitutional under the Commerce Clause,” Governor Christie went on advocate for a full repeal of the 2002 law with no additional mandate.

With the bill having been pocket vetoed and sent back to the statehouse, the New Jersey legislature can either amend the bill to Governor Christie’s liking or it will die in the state senate. If the bill dies, the 2002 law will remain in place in its entirety without any amendment. Therefore, until it is amended or repealed, the law could continue to have the same stifling effect on nation-wide smart gun availability into the unforeseen future.

Senator Weinberg has publically offered to repeal the 2002 law in its entirety if the National Rifle Association (NRA), promised to not impede or block the “research, development, manufacture or distribution of this technology.” However, to date, there has not been any movement on this offer.

It is frequently said that the law lags behind technology. More often than not, this is true (see 1986 Electronic Communication Privacy Act). Yet, this time, the law and legislative process is not lagging behind technology, but rather, with full recognition and understanding, is choosing to stifle technology. Who knew that a little New Jersey law would have such an unintended consequence? For fifteen-years and counting, partisan division and policy differences have kept available technology out of reach from American citizens. Perhaps soon, the technology will become available under conditions favorable to all Americans, politicians and private citizens alike.

Merissa Pico is from Fort Lee, New Jersey and graduated summa cum laude from Boston University’s College of Communication in 2015 with a B.S. in Mass Communication Studies. She is expected to earn her J.D. from Boston University School of Law in 2018. Merissa will be working at Ropes & Gray in New York City in the summer of 2017 and is looking forward to continuing to explore her interests in entertainment and communications law.

Merissa Pico is from Fort Lee, New Jersey and graduated summa cum laude from Boston University’s College of Communication in 2015 with a B.S. in Mass Communication Studies. She is expected to earn her J.D. from Boston University School of Law in 2018. Merissa will be working at Ropes & Gray in New York City in the summer of 2017 and is looking forward to continuing to explore her interests in entertainment and communications law.

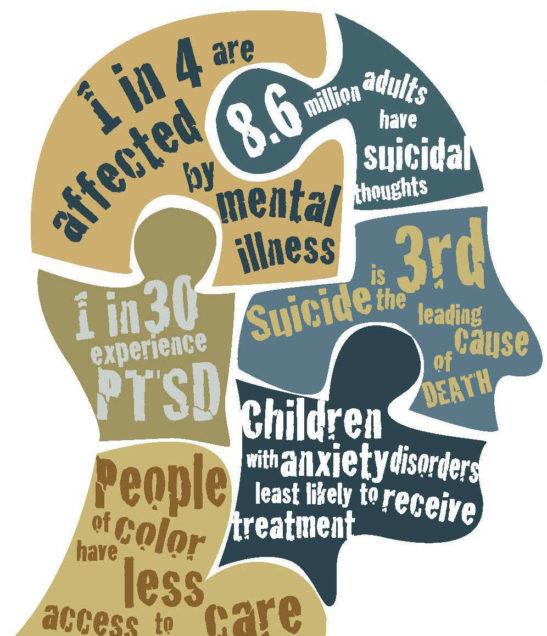

Finding Equity in Mental Health Reform

Mental health has been a very serious topic in recent years, and one of growing concern in American society. Mental illness among teenagers continues to rise, and so do the costs of mental health treatment. Health care in general is a major and complicated issue in the United States, as Republicans in Congress found in their attempts to repeal and replace the Patient Protection and Affordable Care Act (“ACA”). In recent decades federal and state legislation have greatly improved access and provided needed consumer protections, but many of the most important protections are in jeopardy. If current Congressional action is any indication, mental health reform may take several steps backward under the new administration.

Mental health reform became a federal issue in 1996 when Congress passed the Mental Health Party Act (“MHP”). It was a weak first attempt at fixing persistent problems in the American health insurance market. Up until the passage of the MHP, insurance providers openly discriminated against mental health claims and treatment. The MHP was the federal government’s attempt to address the disparity between mental health coverage and traditional medical/physical health coverage. However, the original MPH was gutted in Congress before passage, leaving behind a weak law that barely fixed disparities and discrimination in mental health coverage.

During the congressional debates to get the MHP passed, many were concerned about the economic and practical costs of the initiatives to provide equal protections for mental health and medical care. However, the major success of the MHP was that it demonstrated to lawmakers that providing coverage for mental health treatments was not only beneficial, but that it could be done in a cost effective manner.

After the passage of the 1996 Act, the states responded and attempted to bridge some of the gaping holes left by the MHP. In many cases, states created stricter mental health parity laws than the federal government. This sparked a general acceptance and trend toward improving mental health parity. As opposition to mental health parity was drowned out by support for increased regulation and consumer protections, Congress felt encouraged to try their hand again at providing equal treatment for mental and medical health coverage. The 2008 Mental Health Parity and Addiction Equity Act (“MHPAEA”) was the result of Congress’s second try. The MHPAEA greatly expanded protections for mental health patients and treatment coverage. But alas, there were still major areas in need of reform.

Of particular importance to the current and future state of mental health reform though, came two short years after the passage of the MHPAEA - the ACA. Passed in 2010, the ACA combined with the MHPAEA brought sweeping reform for mental health coverage. Mental health coverage falls under the Essential Health Benefits mandate requiring every insurance provider to provide consumers with mental health coverage. Coupled with the MHPAEA, which requires any insurance provider to treat mental and medical claims equally, mental health coverage is now equal in the eyes of the law to medical coverage.

Since the passage of the ACA though, the practical impact of the reforms have resulted in more covert discrimination of mental health claims that are chipping away at important health care resources that are increasingly vital in American society. Despite laws requiring equal treatment, insurance providers decline mental health claims at higher rates than medical claims. Additionally, insurance providers also make it hard for mental health treatment providers to get paid thereby limiting the physical amount of help available.

The ACA made significant gains in mental health reform, however the lack of practical results has preserved mental health reform as a serious issue of concern. Recently, Congress enacted the 21st Century Cures Act (“Cures Act”), which addresses many pressing concerns that were not covered under the ACA. Most notably, the new act uses modern ideas to address mental illness concerns and substance abuse issues. However, a major concern with the Cures Act is that despite its passage, the House must choose to fund it. Otherwise, all the legislative action prescribed by the new federal law is moot.

Unfortunately, many are speculating that Congress and the Administration will be at odds over the budget putting federal funds for mental health in jeopardy. This is especially so given the fight over funds for various Republican and Presidential pet projects. For example, the President is strongly urging the Republican controlled Congress to allocate funding for his pet project, the border wall between the United States and Mexico. However, House Speaker Paul Ryan and many Republican representatives are more interested in changing funding allocations for health care in an attempt to bounce back after the humiliation of their previous attempt at altering the ACA.

If the recent efforts to "repeal and replace" the ACA was any indication of what the future holds for mental health reform, then America will take a step backward leaving millions without coverage thereby exacerbating an already growing problem. The House passed AHCA attempted to gut the ACA, and would have remove the individual mandate and significantly altered the Essential Health Benefits requirement. Under the AHCA, Ryan tried to remove the requirement that Medicaid and Medicare must follow the Essential Health Benefit mandate, which would effectively prevent millions of the most vulnerable in society from accessing affordable mental health resources.

The fate of mental health coverage and treatment access in many ways is tied to the continued success and longevity of the ACA and funding options for current mental health legislation. To remove the current federal mental health protections, as was proposed in the AHCA, would set progress back and make it nearly impossible for millions to have access to affordable mental health treatments. As the need for mental health treatments and resources grows, we as a nation should not be removing protections and federal funding for progressive initiatives. We should continue to follow the path of the Cures Act and further pursue these initiatives. In order for mental health treatment to be improved subsidies need to be provided for mental health treatment providers (such as psychologists) to incentivize them to open practices and facilities in critical shortage areas. Additionally, federal and state regulations need to address the manner in which insurance providers treat mental health providers.

The current legal framework as a whole is very fair, but needs stricter enforcement on the ground. What use are laws and protections if no one is incentivized to follow them? Of the greatest important, however, is that future laws and regulations intending to improve the state of mental health coverage need to stop attempting to create equality between mental health and medical treatment. Medical and surgical procedures are inherently different than mental health procedures and thus legal equity is needed in order to improve access and provide needed consumer protections.

Is There Such a Thing as Free College?

New York became the first state to make tuition free for two- and four-year colleges for certain students. Governor Andrew Cuomo first introduced his Excelsior Scholarship plan in January 2017, and signed it into law in April 2017. New York State’s Excelsior Scholarship will provide free tuition to students whose families earn less than $125,000 for all public two- and four-year colleges in New York, covering State University of New York (SUNY) colleges as well as City University of New York (CUNY) colleges. The estimated cost if this Excelsior Scholarship is $163 million, amounting to only 0.1% of New York State’s budget. Governor Cuomo, in announcing his plan, said “In this economy, you need a college education if you’re going to compete.” He explained, “It’s incredibly hard and getting harder to get a college education today. It’s incredibly expensive and debt is so high it’s like starting a race with an anchor tied to your leg.” Based on projections, around 940,000 New York households have college-aged children who would qualify for the program.

“[T]he cost of attending college has risen at a much faster rate than the median income, putting even middle-class families in a tough spot when trying to figure out how to finance their children’s college education.” According to the Institute for College Access and Success, about 59% of students graduate from New York’s four-year colleges with debt, on average about amounting to $29,320 of debt. The program will work by giving a scholarship to students whose existing federal and state need-based loans do not fully cover the $6,470 list price tuition at public institutions. Students who currently pay no tuition out of pocket because they receive enough financial aid, through Pell Grants or New York Tuition Assistance grants, to cover tuition, will not receive any funding from the Excelsior Scholarship. This is problematic, as the Scholarship targets students from middle income families, instead of helping students from lower income families who struggle to pay for living expenses, books, and transportation even though they may not be paying out-of-pocket for tuition. Additionally, in order to be eligible for the Excelsior Scholarship students must enroll in 30 credits per year, therefore excluding part-time students.

Added to New York’s law at the last minute, just before it was signed, was a clause that turns the scholarship into a loan if the student leaves the state within four years of graduating (assuming they received four years worth of funding). This subsidy-turned-loan is problematic for many reasons. It both impedes the ability to work in the national labor market, as well as could incentivize unemployed graduates to stay in New York rather than leave the state to find a job elsewhere. Additionally, the converted subsidy-turned-loan would not have the same benefits as a federal student loan, like the income-based repayment arrangement.

Some of New York State’s public officials were not thrilled with the plan. New York State Assembly Republican Leader Brian Kolb stated “Governor Cuomo isn’t providing ‘free’ tuition, he’s simply telling New York taxpayers to write a bigger check.” Other Republican lawmakers criticized the Governor’s proposal during budget negotiations for excluding students at private colleges. Additionally, while SUNY Chairman Carl McCall and Chancellor Nancy Zimpher “applauded the budget deal” and called it “truly ground-breaking,” they also had “hoped for additional support,” specifically for SUNY community colleges.

With this program, New York joins other states and cities in providing free college. Tennessee, Oregon, and San Francisco have recently made tuition free at community colleges for all residents, regardless of income. Additionally, Rhode Island is now considering a proposal that would make two years at public colleges tuition-free. Unlike the Excelsior Scholarship in New York, the proposal in Rhode Island would allow every Rhode Island resident who graduates high school in-state to be eligible for two-years free tuition at the University of Rhode Island, Rhode Island College, and the Community College of Rhode Island, regardless of income. Interestingly, the Rhode Island proposal makes it so the scholarship could only be used for a students’ junior and senior years at four-year colleges. Projections from the Rhode Island Governor’s office expect that the program would benefit 8,000 students and cost $30 million a year, less than 0.5% of the state’s budget. The proposed plan, a “last dollar” scholarship, would “cover the gap a student has on their tuition bill after using up any federal or state grants he or she already receives.”

Additionally, college tuition has been a topic on the federal level. President Trump has proposed cutting $5 billion in higher-education for lower-income Americans. Senators Bernie Sanders and Elizabeth Warren, along with Representative Keith Ellison and other members of Congress, introduced the College for All Act, with the hope to eliminate tuition and fees at public four-year colleges and universities for students whose families make under $125,000 per year. The bill proposes that the federal government would pay 67% of tuition subsidies at public colleges and universities, and state and tribal governments would pay the other third. While the bill likely will not pass with a Republican Congress and Trump in the White House, it has been backed by the United States Students Association, the American Federation of Teachers, and the National Education Association.

While these college tuition subsidies could be extremely beneficial in allowing more students to attend college who previously could not afford it, there are many controversial issues in the scholarship plans. Who ends up paying for the scholarship? Does college truly prepare graduates for the workforce? And lastly, with all the strings-attached to New York State’s Excelsior Scholarship, can it be said that there is such a thing as free college?

At Last: New York Remembers the Adolescence of its Juveniles Offenders

On April 10th of this year, New York became the 49th state to pass legislation ending the treatment of 16 and 17 year olds as adults in the criminal justice system. Assembly Speaker Carl Heastie touted the bill’s passage as a “tremendous victory for communities across the state that have endured senseless tragedies and called on the Legislature to deliver a justice system that recognizes the difference between a child and an adult.” While New York was one of only two states to continue to prosecute these juveniles as adults, the Assembly had been working to pass similar legislation for over 12 years.

The prosecution of juveniles in adult criminal court has been proven to have serious lifelong consequences. The human brain is not fully developed until the age of 25, before juveniles mature they often lack impulse control and the ability to anticipate and understand the consequences of their actions. Adolescents tend to be receptive to interventions, responding well to juvenile treatment and services by learning to make responsible choices and ending delinquent behavior. Studies show that youth offenders prosecuted and sentenced in the adult criminal justice system are 34% more likely to be re-arrested than juveniles who are charged in the youth justice system. In addition to the impact that the adult criminal justice system has on the juvenile’s future behavior, youth offenders detained in adult prisons are more likely to be beaten by staff, sexually assaulted, 50% more likely to be attacked with a weapon, and are 36 times more likely to commit suicide while detained.

New York’s Raise the Age bill has multiple facets. Under the new legislation, 16 and 17 year olds accused of misdemeanors will be sent to Family Court. Felony cases, however, will remain in adult criminal court in a new section called the “youth part,” which will house judges trained in Family Court law. After 30 days, 16 and 17 year olds charged with nonviolent felonies will be sent to Family Court unless a district attorney has proven that there are “extraordinary circumstances” that warrant the juvenile’s retention in the adult criminal system. The term “extraordinary circumstances” is undefined in the new law, although Alphonso David, the governor’s counsel, has stated his belief that it will be widely understood to mean “remarkable, exceptional, amazing, astounding, incredible.” Those juveniles charged with violent felonies may also be transferred to Family Court if they pass a three-part test. The test balances whether the victim sustained significant physical injury, the accused used a weapon, and whether the perpetrator engaged in criminal sexual conduct.

The bill also changes the rules regarding the detention of juveniles. After the horrible details surrounding the arrest and detention of Kalief Browder became public knowledge, there was a powerful push for juvenile detention reform. Kalief Browder was a 16-year-old kid living in the Bronx in 2010 when he was arrested for allegedly stealing a backpack. Mr. Browder never faltered in his denial of guilt, despite this he was detained on Rikers Island for 3 years, two of which were spent in solitary confinement, without charges. The time spent on Rikers, replete with assaults by guards and inmates, solitary confinement, and awaiting a trial that never came affected his mental state in ways that would be expected of anyone, let alone a teenager. Two years after his release from Rikers Island, Mr. Browder committed suicide and became a household name reflecting the horrors of the criminal justice system for the youth of New York. The Raise the Age legislation, signed by Governor Cuomo with Kalief Browder’s brother, Akeem, looking on, is an attempt to prevent a tragedy such as this from ever occurring again. Beginning October 1st, 2018, offenders under 18 will no longer be held at Rikers Island and those 17 years old will no longer be held in county jails, a similar rule will be enforced for those under 18 a year later.

Despite victory for proponents of the bill, many are disappointed in the newly passed legislation. Last year alone, 3,445 juveniles were charged with violent felonies and therefore would still have been prosecuted in the “youth part” of the adult criminal system. Those adolescents will continue to receive lengthy prison stays and lifetime criminal records. Kevin Parker, a State Senator from Brooklyn, voiced his consternation at how complicated this bill became, “[a]ll we had to simply do is say that we’re going to take 16- and 17-year-olds and we’re going to treat them just like 15-year-olds. That’s all we had to do, right? All we had to do. And we messed that up.”

While New York’s bill may not be perfect, it will give many young offenders an opportunity to learn from their mistakes and become law-abiding adults. Over 17,000 adolescents aged 16 and 17 are accused of misdemeanors each year, under the new bill these charges will be heard in family court where judges are trained to know what is best for the adolescent offender and have more access to social services that may help rehabilitate rather than strictly penalize this vulnerable community. The change in detention facility alone will mean the difference between a mistake and lifetime behavior for many, for some it will mean the difference between life and death. A staunch supporter of the original bill, Senator Diane Savino of Staten Island, made it clear that the fight to raise the age for adult criminal liability is far from over. “For those who don’t think it goes far enough, I will remind you: We are not dropping off the end of the earth tonight. Laws are made to amend them.”

Alexandra Raymond is from Vergennes, Vermont and graduated from New York University in 2014 with a B.A. in Sociology and Law & Society. She is expected to earn her Juris Doctor from Boston University School of Law in 2018. Alexandra will be working for an investment management firm in Boston during the summer of 2017 and will then spend her next semester studying international law at Leiden Law School in the Netherlands. Upon graduation, Alexandra hopes to pursue a career that allows her to explore her interests in business, social justice, and international law.

Alexandra Raymond is from Vergennes, Vermont and graduated from New York University in 2014 with a B.A. in Sociology and Law & Society. She is expected to earn her Juris Doctor from Boston University School of Law in 2018. Alexandra will be working for an investment management firm in Boston during the summer of 2017 and will then spend her next semester studying international law at Leiden Law School in the Netherlands. Upon graduation, Alexandra hopes to pursue a career that allows her to explore her interests in business, social justice, and international law.

How State Medicaid Reimbursements are Limiting Hepatitis C Coverage and Solutions

Hepatitis C has rapidly become a major public health problem, and accessibility to new and affordable treatments has been highly sought after. Hepatitis C virus (HCV) can be transmitted by blood transfusions or contaminated needles; although no symptoms are present at the outset, chronic Hepatitis C infection can give rise to liver complications such as cirrhosis or liver cancer. As the leading infectious killer in the U.S., HCV chronically infects 2.7 million to 3.5 million people in the U.S. Since first coming onto the U.S. market in in 2013, Sovaldi has been one of the few, if only, medications to successfully treat Hepatitis C at a cure rate of over 90% after 12 weeks of treatment, with few side effects. Sovaldi holds considerable exclusivity due to its novelty. As such, Sovaldi costs $1,000 per pill, leading to a costly $84,000 for a 12-week treatment regimen. In contrast, Sovaldi costs less than $1 per pill.

Sovaldi pricing has received nationwide attention; to the point of rare bi-partisan partnership taking action. On July 11, 2014, Senate Finance Committee Ranking Member Ron Wyden (D-Oregon) and senior Committee Member Chuck Grassley (R-Iowa) requested information on Gilead Sciences’ pricing tactics that have negatively affected public payers’ access to Sovaldi. The lawmakers deemed the investigation pertinent since the medication raises “serious questions about the extent to which the market for this drug is operating efficiently and rationally,” and Sovaldi’s price “appears to be higher than expected given the costs of development and production and the steep discounts offered in other countries.” After an 18-month investigation and hearing, Congress released an extensive report on December 1, 2015, detailing Gilead Sciences’ pricing, marketing, and development mechanisms on Sovaldi and Harvoni.

Among other conclusions explaining the price variation, the report determined that Gilead did not easily provide access to states’ Medicaid programs. Medicaid programs spent $1.3 billion on Sovaldi, before rebates, in 2014 alone, yet less than 2.4 percent of Medicaid-eligible patients with HCV received treatment. In fact, many states have resorted to restricting access to covering a limited number of Medicaid patients. Some states, such as New Mexico, limit Medicaid coverage to the sickest patients, or those who have pre-existing liver damage. These states require healthcare providers to “perform risky liver biopsies on patients to prove how sick they are, or wait until patients have late-stage liver disease before they can be eligible for coverage.”

A recent study examined how consistently state Medicaid programs abided by recommendations made by the American Association for the Study of Liver Disease and the Infectious Diseases Society of America on treating, managing, and preventing HCV. Out of the 42 states (including the District of Columbia) that had publicly available Medicaid reimbursement criteria, 74% restricted access to Solvaldi to those with advanced fibrosis or cirrhosis, which occurs at stage F4 of the disease. Furthermore, a majority of states limit Medicaid reimbursements to patients who have abstained from drug and alcohol use for a certain period of time, even those who have undergone opioid substitution therapy. From these findings, the study concluded that current state Medicaid reimbursements may violate federal Medicaid law, which provides that state Medicaid programs plans must include drugs manufactured by pharmaceutical companies that have negotiated rebate plans with the Secretary of Health and Human Services, except for those under the restrictive lists of drugs.

Some states have rearranged their Medicaid program policies by forming a pool with other states and purchasing alternative treatments exclusively in an effort to force coverage away from Solvaldi. As of January 2015, Missouri and 24 other states successfully reached a negotiation with AbbVie to secure an extra 20 to 30 percent rebate system for their Medicaid patients. However, these negotiations place restrictions on Medicaid enrollees, who are required to stay sober for 90 days before beginning the Viekira Pak treatment. Although Missouri anticipates to save $4.2 billion from these rebates, the lag time of over six months for calculating rebates into the state budget means it will be too soon to determine the overall cost savings on Medicaid spending. The Missouri state department also plans to provide Solvaldi to an estimated 15 to 20% of HCV patients who cannot be effectively treated by Viekira Pak, which implies that the medication cannot clinically treat all people infected by HCV. Exclusive Medicaid negotiations with alternative treatments could lead to unintended leftover costs from providing for patients whom Viekira Pak is not a valuable option.

Recent litigation on the state level has addressed issues of Medicaid coverage of Sovaldi. In B.E. v. Teeter, Washington Medicaid enrollees, who were HCV patients that did not receive DAA medication, brought a class action suit against the Washington State Health Care Authority (“WHCA”), under claims of violating the Medicaid Act for categorically excluding them from “medically necessary” drugs. The federal district court sided with the plaintiffs’ argument, granting their motion for preliminary injunction, given that the plaintiffs had satisfied all the factors necessary to warrant such a remedy. In doing so, the court determined that the plaintiffs’ evidence “will likely establish that the WHCA is failing to follow its own definition of medical necessity by refusing to provide DAAs to monoinfected enrollees with a F0-F2 score and offering only “monitoring” in lieu of this breakthrough treatment.”

This decision significantly marked the first time that a federal court deemed restrictions to Hepatitis C state Medicaid programs as illegal, and thus could provide a precedent for other states to follow suit. Consumers from California and, again Washington, have also recently filed suits against private insurance companies, such as Anthem Blue Cross and Group Health Cooperative. Since these lawsuits have involved gathering a class of injured plaintiffs, however, issues of class certification under Rule 23(a) and 23(b)(2) will need to be resolved, as they were in B.E. v. Teeter. As such, law suits filed on behalf of a consumer class may not be the most efficient resolution, since time constraints and litigation costs could prolong the desired remedy, if the court chooses to grant it.

Massachusetts employs a fee-for-service program for distributing Solvaldi. As such, the state has relatively unrestricted access to Sovaldi compared to other states; yet, only an estimated 1,075 members have been approved for treatment regimens among the 7,658 members living with HCV. In an unprecedented move, on January 2016, Massachusetts Attorney General Maura Healey issued a letter warning to sue Gilead Sciences for potentially violating unfair trade practice under section 2 of chapter 93A of the Mass. Gen. Laws. However, the lawsuit may not contain the merits required to bring an action under consumer protection law. The AG eventually spent months negotiating with Gilead Sciences and recently, on June 30, 2016, reached a new drug rebate program to provide unrestricted coverage to MassHealth patients in need of Hepatitis C treatment. Since the MassHealth rebate program was recently implemented on last August 1st, the effectiveness of the pricing solution will need to be monitored further to determine whether Medicaid coverage of Solvaldi is expanded to offer more treatments to those in need.

Monica Chou anticipates graduating from Boston University School of Law in May 2018 and plans to practice health law.

Monica Chou anticipates graduating from Boston University School of Law in May 2018 and plans to practice health law.

With Obamacare in peril, the Governors Speak Out

Before the Affordable Care Act (ACA), I did not have health insurance. My home state Florida did not mandate health insurance coverage for residents and my undergraduate university did not require me to have health insurance. In essence, I was a typical American in my early 20s. I did not think I needed health insurance, was not required to carry it, and could not afford it. Cost was the greatest factor: I did not have any income and Florida did not expand Medicaid. To my surprise, the ACA allowed me to have affordable health insurance for the first time as an adult. Now Congress is contemplating major changes to the ACA (or commonly called Obamacare), causing some governors, such as Charlie Baker (R-Massachusetts), to weigh in on the proposals. Despite the recent successful House repeal and replacement of the ACA, the Senate is now struggling to find a path forward under the budget reconciliation rules.

Just a few months ago, it looked as though changes to the ACA were inevitable given the unified Republican control of Congress and the Administration. Despite seven years of discussion of repeal, and more recently the repeal and replace vote, the future is still uncertain. Members of Congress who attended town hall meetings during the 4th of July break heard from many constituents who are deeply concerned with loss of coverage. Former House Speaker John Boehner recently said that Congress would not repeal and replace, but instead “fix” Obamacare. And now, the Senate is spinning its wheels.

The much-awaited House bill, the American Healthcare Act (the “AHCA”), was the first attempt at replacing the ACA. The AHCA would repeal tax penalties for people without health insurance, reduce federal insurance standards, cut subsidies for buying private insurance and establish new limits on spending for Medicaid. In their first attempt, Republicans failed to get their bill to reach the House floor for a vote. In spite of this defeat, the Trump Administration placed renewed pressure on Congress to revise the ACA. Ultimately, the House was able to pass the bill in its second try by adding $8 billion to help cover insurance costs for people with pre-existing conditions. However, the Senate cannot pass the House bill because Majority Leader McConnell must accommodate Republican senators from states that have expanded Medicaid under the ACA. These senators, with a statewide constituency, must consider what their state governors have to say on revisions to the ACA.

Congress' ACA replacement process included a request to the 50 governors for information. In response, Massachusetts Governor Baker sent a letter on the ACA’s impact on Massachusetts. Some commentators believe Governor Baker’s letter could carry extra weight because of his Republican party affiliation and his past work experience as chief executive of Harvard Pilgrim Health Care gives his suggestions and concerns greater authority.

In his letter, Governor Baker discussed the importance of the health sector to the Massachusetts economy; $19.77 billion, making it one of the leading industries in the state. Governor Baker also noted that the ACA was modeled after the Massachusetts system, which was intended to provide close to universal coverage for residents. Massachusetts has the highest percentage of insured residents in the U.S.— 96.4%. Just under 60% of the insured are covered through the employer-sponsored insurance market.

Governor Baker argued that lawmakers should not repeal the ACA, but revise it. One area in need of repair is the ability of individuals with employer provided insurance to switch to tax-payer subsidized health insurance; something half a million Massachusetts residents have done since 2011. As a result, Medicaid now accounts for close to 40% of the state’s budget. Since 2012, the percentage of Massachusetts residents on commercial insurance decreased by 7% while Medicaid enrollment increased by 7% and now insures 28% of the population. The original Massachusetts program did not allow this transfer, but the State was forced to comply with the introduction of the ACA. Now, this particular aspect of the ACA was straining the Massachusetts system and needed to be revised. Although Governor Baker offered reforms, he argued for maintaining several aspects of the law, such as the mandate requiring all residents to carry health insurance, which would allow stability within high-risk pools for insuring people who are sick.

The Governor continues to push the goal of universal health care coverage, but recognized such a goal was in jeopardy because of certain Congressional proposals. For instance, the letter expressed concern over a shift to block grants for Medicaid funding to the states. The Governor argues that a shift to block grants (or “per capita caps for Medicaid) would “remove flexibility from states” as the result of lower federal funding. Under current law, the federal government and state governments share in the financing and administration of Medicaid. According to the Congressional Budget Office, states typically pay health care providers for services to enrollees, and the federal government reimburses states for a percentage of their expenditures. Furthermore, all federal reimbursement for medical services is “open-ended” in other words, if a state spends more because enrollment increases or costs per enrollee rise, additional the federal government matches. Currently, Massachusetts is a 50/50 state, meaning that the federal government and Massachusetts divide the cost of providing health care for Medicaid recipients.

Despite Governor Baker position, the House passed AHCA creates a per capita-based cap on Medicaid payments for medical assistance. The per-capita caps would establish a limit on the amount of reimbursement the federal government provides to states. For instance, if a state spent more than the federally established limit on reimbursements, the federal government would not match the additional costs. The AHCA would punish Massachusetts low income residents and threaten the stability of the MassHealth system. Consequently, the changes to federal grants of funds could impact the Commonwealth’s goal of universal healthcare.

Today, Governor Baker—joined with nine other governors, including Gov. Sandoval (R-Nevada) and Gov. Kasich (R-Ohio) —sent another letter to the Senate urging it to correct the ACA's weaknesses without repealing the law or gutting Medicaid. The Governors wrote, "lasting reforms can only be achieved in an open, bipartisan fashion." The governors also called on the Senate to heed U.S. Sen. John McCain's, R-Arizona, impassioned plea to return to "regular order" and not continue the recent practice of hyper partisanship.

The governors are speaking; the question remains whether Congress is listening.

Juan Garay graduated from Boston University School of Law in 2017.

Juan Garay graduated from Boston University School of Law in 2017.