From Productivity to Firm Growth

James Bessen and Erich Denk

Despite the received wisdom that more productive firms grow faster than less productive ones, little empirical research explains why and how this happens. Our research explores factors that might affect how quickly firms grow in response to productivity.

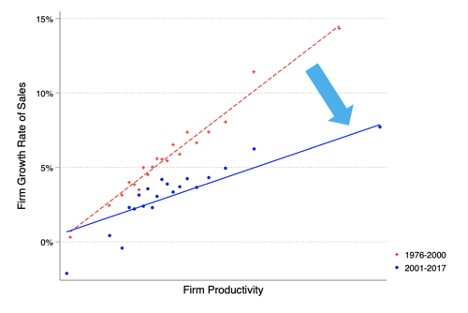

This is an important question. Faster growth by more productive firms is an essential part of aggregate productivity growth–as more resources are allocated to more productive firms, aggregate productivity rises. And Schumpeterian disruption occurs when faster-growing firms displace incumbents. Yet disruption, even by the most innovative and productive firms, can take time — sometimes a decade or longer. Recent research has found that productive firms have grown more slowly since 2000 in response to productivity, contributing to slower aggregate productivity growth (see Figure). The dramatic drop in responsiveness poses a significant puzzle.

Figure: Binned scatterplot of firm growth rate against lagged productivity by time period. Controls for industry and year. Details in the paper.

Figure: Binned scatterplot of firm growth rate against lagged productivity by time period. Controls for industry and year. Details in the paper.

A number of theoretical papers attribute slow growth of productive firms to a variety of informational frictions. It may take consumers time to find out the quality or even the existence of a new product. They might gain this information through word-of-mouth communication or from advertising or through trial-and-error search. We build a model that incorporates these various mechanisms and which provides an equation that allows us to estimate their effects. The model relates consumer surplus to firm productivity, so that consumers choose to switch to more productive firms. Two general factors affect how firm growth rates respond to firm productivity: 1) larger firms tend to grow more slowly relative to their size, and 2) firms grow more slowly in response to productivity in industries that have greater productivity dispersion, that is, greater overall variation in productivity. Intuitively, firms with large market shares have fewer customers they can acquire relative to their size, so their growth rates are relatively lower. And when the firms in an industry have larger differences between their productivity levels, a firm must increase its productivity relatively more in order to induce consumers to switch.

To explore a proof of concept, we test the model using data on publicly listed firms from Compustat, estimating a firm revenue productivity function. Importantly, our production function incorporates stocks of intangible capital measured in a variety of ways. We find that firm size and productivity dispersion significantly affect the response (slope) of firm growth rates to productivity. These two factors account for about half of the decline in slope seen in the Figure.

We extend our basic model in two ways. First, we consider how product differentiation might affect firm growth. Significantly, dominant firms tend to make proportionally larger investments in intangibles, such as advertising and proprietary software, which can differentiate their products. Those investments may make consumers less willing to switch to a new firm or product, thus slowing the growth of productive firms. We explore the effect of intangible investments made by the top four firms (by sales) in each industry on the growth of smaller competitors and find significantly slower growth rates as predicted.

Second, we consider aggregate industry productivity growth. Because large firms grow relatively more slowly, productive large firms contribute less to aggregate productivity growth than do similarly productive smaller firms. The net effect is that, under some conditions, more concentrated industries will tend to have lower productivity growth, all else equal. Industries with greater productivity dispersion will also experience slower growth on average. Although our data do not include all firms, we aggregate industry productivity and find that productivity growth rates are lower in more concentrated industries and in industries with greater productivity dispersion.

This research provides new tools for analyzing firm growth in response to productivity. These tools can be applied to more comprehensive databases of firms and with better data on intangibles. In addition, the model suggests new ways of thinking about the role of large firms in productivity growth that might prompt a somewhat different approach to competition policy.